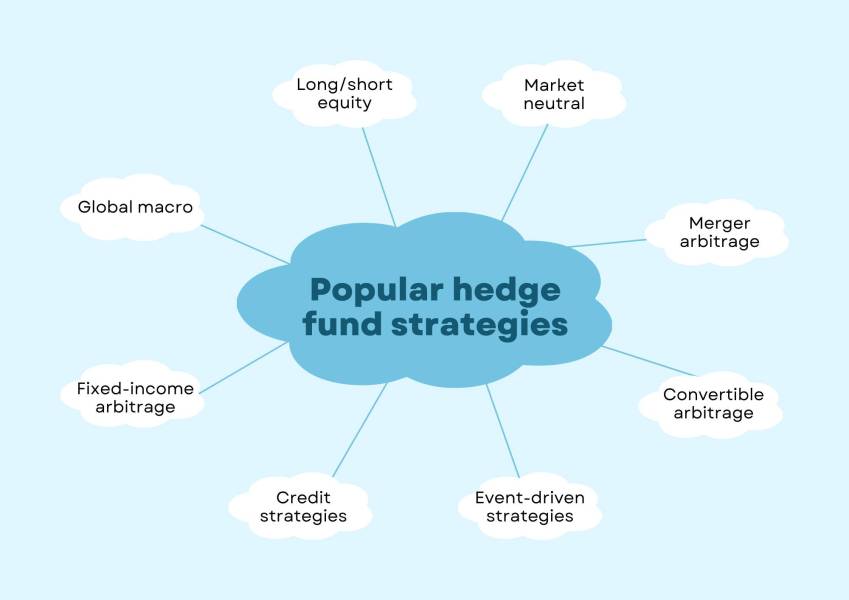

Long/short equity, market neutral, merger arbitrage… What are the popular hedge fund strategies?

Hedge funds are a type of investment that pools money from accredited investors to aim for returns that are higher than what the market typically offers. They use various strategies, such as borrowing money (leverage), financial contracts (derivatives), and other tools to take advantage of opportunities in the market.

Hedge funds are a type of investment that pools money from accredited investors to aim for returns that are higher than what the market typically offers. They use various strategies, such as borrowing money (leverage), financial contracts (derivatives), and other tools to take advantage of opportunities in the market.

Unlike mutual funds, which are more regulated, hedge funds face fewer restrictions, giving them more freedom to invest. However, these funds usually require a large amount of money to get started and come with higher risks. For these reasons, hedge funds are mostly suitable for wealthy individuals or institutions.

Here is an overview of the key strategies used by hedge funds, showing how they work, their benefits, and risks.

Key features of hedge funds

Hedge funds differ from traditional investment options in several ways:

- Leverage and derivatives: Hedge funds often borrow money or use contracts to increase their investment potential. This allows them to make bigger trades than their capital alone would allow.

- Short positions: Hedge funds can make profits when the price of an asset falls, which adds diversity to their strategies.

- Flexibility: Hedge funds can invest in many different types of assets, including stocks, bonds, commodities, and currencies.

Popular hedge fund strategies

1. Long/short equity

The long/short equity strategy, introduced by Alfred W. Jones in 1949, remains one of the most prevalent approaches. Managers identify undervalued stocks for long positions and overvalued stocks for short positions. This approach reduces overall market risk by offsetting long positions with shorts.

For example, if a manager expects General Motors (GM) to outperform Ford, they might go long on GM and short on Ford. This creates a neutral market exposure, ensuring profits are driven by relative performance rather than market trends. Long/short equity strategies thrive in environments where stock-specific factors dominate broader market movements.

2. Market neutral

Market-neutral strategies aim to eliminate market risk by maintaining balanced long and short positions. These funds generate returns solely from stock selection, avoiding broader market influences. While this strategy reduces risk compared to long-biased approaches, the potential returns are often lower.

Market-neutral strategies face challenges in environments where stocks move in unison, as seen during periods of extreme market sentiment. Additionally, returns are affected by factors such as interest rates, which influence earnings from cash collateral.

3. Merger arbitrage

Merger arbitrage is an event-driven strategy focused on opportunities arising from corporate mergers and acquisitions. After a deal is announced, managers invest in the target company’s stock and, if applicable, short the acquiring company’s stock. Returns are derived from the spread between the target company’s current stock price and the merger consideration.

However, this strategy entails significant risks. Deals may fail due to regulatory issues, shareholder opposition, or adverse changes in the target company’s business. Managers must thoroughly assess these risks before committing capital.

4. Convertible arbitrage

Convertible arbitrage involves taking long positions in convertible bonds and short positions in the underlying equity. This strategy seeks to maintain a delta-neutral position, where gains in one position offset losses in the other. Managers adjust their hedges as market conditions fluctuate, capitalising on volatility to achieve returns.

Convertible arbitrage performs well in stable or declining volatility environments but can suffer during periods of extreme market stress. Event risks, such as takeovers, can also impact returns if conversion premiums collapse unexpectedly.

5. Event-driven strategies

Event-driven strategies focus on opportunities related to corporate events, such as bankruptcies, restructurings, or mergers. Managers often invest in distressed companies, taking positions in senior debt, which has the highest repayment priority. Returns are driven by the recovery value of these assets.

These strategies are most effective during periods of economic growth, when corporate activity is high. However, they require patience and the ability to navigate uncertainties, as corporate reorganisations can take months or years to materialise.

6. Credit strategies

Credit hedge funds focus on identifying relative value opportunities within a company’s capital structure. Managers analyse the pricing of senior and junior debt or different tranches of structured products, such as mortgage-backed securities (MBSs) or collateralised loan obligations (CLOs).

Credit funds often hedge interest rate exposure to isolate credit-specific risks. These strategies perform well during periods of economic expansion, when credit spreads narrow, but they face challenges during economic slowdowns.

7. Fixed-income arbitrage

Fixed-income arbitrage seeks to profit from discrepancies in government bond pricing. Managers take leveraged positions based on anticipated changes in the yield curve. For example, if long-term rates are expected to rise relative to short-term rates, a manager might short long-dated bonds while buying short-dated securities.

While these strategies can generate consistent returns, their reliance on leverage increases the risk of significant losses when market conditions move against expectations.

8. Global macro

Global macro strategies involve analysing macroeconomic trends to identify investment opportunities across asset classes, including equities, fixed income, currencies, and commodities. Managers often take directional bets based on their views of economic indicators, geopolitical developments, or central bank policies.

Although global macro funds offer high return potential, they are among the most volatile due to the large, concentrated positions taken by managers. Success depends on accurate macroeconomic forecasts and disciplined risk management.

Risks and considerations

Hedge funds, while offering the potential for significant returns, carry inherent risks that investors must carefully evaluate. Key risks include:

Hedge funds, while offering the potential for significant returns, carry inherent risks that investors must carefully evaluate. Key risks include:

- Liquidity risk: Hedge funds often require investors to keep their money in the fund for a set period, known as the lock-up period. This can last from months to years, and during this time, investors cannot take their money out. Even after this period, some funds only allow withdrawals at specific times. If an investor needs access to their money quickly, this can be a problem.

- Leverage: While using leverage can increase returns, it can also amplify losses. For example, if a hedge fund uses borrowed money to invest and the investment loses value, the losses could be much greater than the initial investment.

- Regulatory risk: Hedge funds are less regulated than other types of funds, which means they have more freedom to take risks but also face greater chances of fraud, mismanagement, or other issues. Investors must trust the fund’s management and ensure they are following good practices.

- Market risk: Even hedge funds that aim to reduce market risk can still face significant losses if markets move unfavourably. Some hedge funds bet on certain market trends, such as currency movements, and can lose money if things go wrong.

Who can invest in hedge funds?

Hedge funds are typically reserved for accredited investors, reflecting their higher risk profile and less stringent regulatory oversight. The US Securities and Exchange Commission (SEC) defines accredited investors as individuals or entities meeting specific financial criteria, including:

- Net worth: An individual must have a net worth exceeding $1 million, excluding the value of their primary residence. This ensures that investors have sufficient financial resources to absorb potential losses without compromising their overall financial stability.

- Income requirements: Alternatively, an individual qualifies as an accredited investor if they have an annual income of $200,000 or more in each of the last two years, with a reasonable expectation of maintaining this income level in the current year. For joint incomes with a spouse, the threshold is $300,000. These criteria are intended to protect less experienced investors from the complexities and risks of hedge fund investments while granting access to individuals and entities with the financial sophistication to evaluate these products adequately.

Key takeaways

- Hedge funds are flexible investment options that use borrowing (leverage), financial contracts (derivatives), and can profit from falling stock prices by taking short positions.

- They use different strategies to aim for higher returns for their investors.

- Hedge fund strategies include approaches like long/short equity and market-neutral investing.

- Merger arbitrage is one type of event-driven strategy, which can also involve investing in companies facing financial difficulties.

Read More:

hedge fund vs asset management

how is having a security system for your home a risk management strategy?

how would reconcile your bank account to avoid spending more than you have?

Himani Verma is a seasoned content writer and SEO expert, with experience in digital media. She has held various senior writing positions at enterprises like CloudTDMS (Synthetic Data Factory), Barrownz Group, and ATZA. Himani has also been Editorial Writer at Hindustan Time, a leading Indian English language news platform. She excels in content creation, proofreading, and editing, ensuring that every piece is polished and impactful. Her expertise in crafting SEO-friendly content for multiple verticals of businesses, including technology, healthcare, finance, sports, innovation, and more.