“Private equity investments are traditionally long-term investments with typical holding periods ranging between three and five years. The average holding period for these deals has in fact been rising steadily ever since the financial crisis, and reached almost six years on average for deals exited in 2014. Yet for companies sold over the first few months of 2015, this average has fallen, which may indicate this trend has turned a corner,” says Christopher Elvin, Head of Private Equity Products, Preqin, a leading source of information for the alternative assets industry.

Buyout Holding Period Falls

In 2015 so far, the average holding period for private equity-backed buyout deals has declined for the first time since 2008 financial crisis. The average time taken to exit private equity-backed buyout investments was rising year-on-year. In 2014, the buyout holding period had reached a record high of 5.9 years from around 4 years in 2008. The average holding period has dropped to 5.5 years in 2015 so far. This U- turn coupled with a strong exit environment is a positive signal for Private Equity.

Private Equity-Backed Buyout Deals at highest level since 2008 Crisis

The total value of buyout deals in Q1 2015 was $97bn, the highest since 2008 crisis. It recorded 14 percent increase over the previous quarter. This includes the $40 billion deal of the merger of food giants Kraft and Heinz, the biggest single deal since 2007. This merger set several new post-crisis records in alternative investments in the first quarter of 2015. This pushed up the total value of buyout transactions in Q1 this year. But globally, there was 20 percent decline in number of deals concluded in Q1 compared to that in the previous quarter. In the first quarter 770 private equity-backed buyout deals were completed, down from 958 in the last quarter of 2014.

Early Stage Venture Capital Funding average size doubles in three years

There is a significant increase in the amount of early stage venture capital being invested in young, innovative companies. Early stage venture capital financings such as seed, angel, series A or round 1 help start-up companies to finance the early development of a new product or service. Data show one fourth of total value of early stage venture capital deals was for the healthcare industry and there is a significant increase in the average size of early stage venture capital deals. The average size for early stage venture capital deals in 2015 so far was $4.1mn, almost double of the average size of $2.1mn in 2012. But it is still 20% less than highest average of $5.2mn achieved in 2007. As the startups need higher investments to rapidly grow their business, the average size of early stage funding would continue to climb.

Fund raising momentum pushes up Dry Powder to all-time high of $1.3 trillion

In 2015 so far, 310 Private Equity funds have reached a final close raising $183bn. The number of small funds closures is however declining. Now there are over 2000 private equity funds looking to raise capital, targeting a total of around $800bn. This will up further increase the figure of dry powder, unspent commitments to private equity funds, which is already at an all-time high of $1.3 trillion. As private equity firms are sitting on piled of cash, as higher valuation in rising markets makes it more difficult to find attractively priced good opportunities.

Investors Prefer large Private Equity

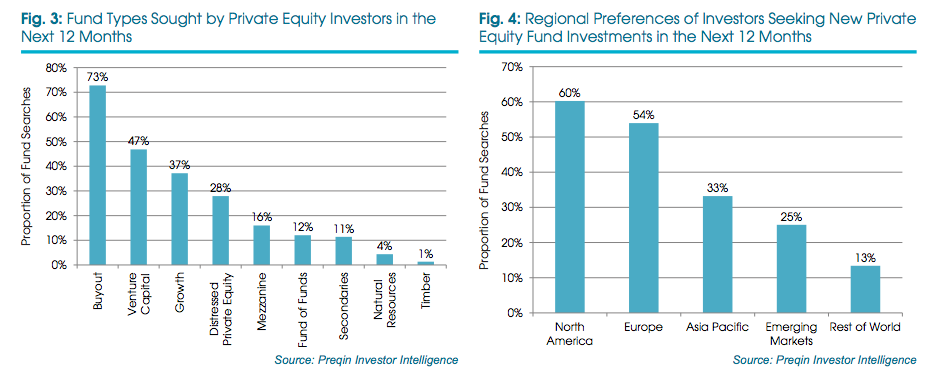

Private equity firms raise funds from long-term investors such as pension funds, Insurance Companies and high net worth individuals. Public Pension Funds, Insurance Companies and Fund of Funds constitute more than half of total number of investors.

They prefer large Private Equity and tested over a period of time. There is a trend of concentration towards large funds. Average fund size has increased to $1.3bn in 2015 YTD.

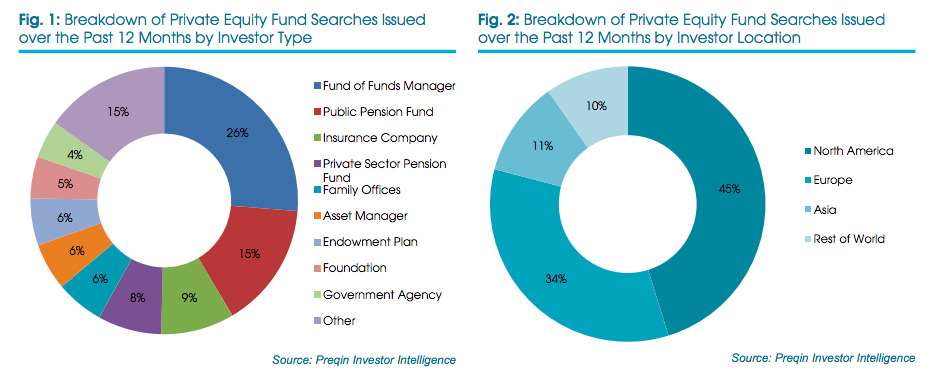

Secondly, PE fundraising remained mostly centered in North America and Europe. Four out of every five investors are from North America and Europe. Over 85 percent of all capital raised in Q1 2015 was by North America-focused funds and Europe-focused funds. A survey reveals investors have preference for Private Equity Funds focused on North America and Europe.

Thirdly, Buyout and Venture Capital Funds are the most sought-after fund types. The investors have indicated that they would generally prefer to invest in Buyout and Venture Capital Funds in next 12 months.

Source: Investor Fund Searches and Mandates, Preqin

This preference is consistent with last year’s trend. In 2014, investors funded $332bn in buyout deals and $86bn in venture capitals, highest since the global financial crisis. In a survey conducted last year, the fund managers had indicated they expect to invest more in 2015.

Source: Investor Fund Searches and Mandates, Preqin

In short, the start of 2015 has been good for Private Equity with highest buy-outs since 2008 financial crisis and falling buyout holding period. But some critical challenges such increasing dry powder and continuing geographical concentration remain to be addressed by the PE managers.

Kanchan Kumar is an experienced finance professional and has worked as an Executive Director and Advisor with the MNCs. He is a former banker with two decades of working experience with a Financial Institution. He is a rank holder in MBA (Finance) and Gold Medallist in MS (Statistics). He has passion for research and has also taught at a University. He writes on Global Economy, Finance and Market.