Last week we had a quieter week after the volatility ahead of the debt ceiling agreement.

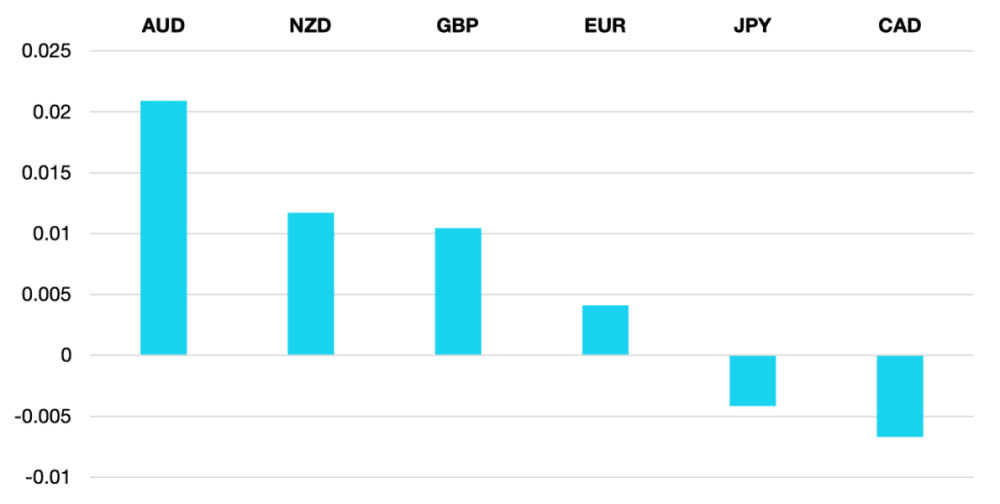

With much detail to digest the market looked towards the CPI and interest rate decisions coming up. The US Dollar traded lower through the week as the FOMC decision could be the last rate rise and thus ending the cycle. The DXY fell 0.5% to around the 103.55 level.

Euro data disappointed with GDP printing a negative number. The Euro lost 0.4% vs the US Dollar but fell against all other majors.

GBP continues to perform with the PMI remaining strong and the economy is showing a good level of strength. GBP continued its rise vs the EUR closing around the 0.854 level.

Commodity currencies had a great week as the USD retreated and risk on continued to move higher. Interest rate rises by the RBA and BoC propelled the pairs higher with CAD rising 0.6% and the AUD up over 2% vs the USD.

Oil is still having some incredible daily swings daily swings but is still stuck in a wide channel. Last week WTI fell 2% to close just above $70.

The week ahead has key economic data. We have the Fed leading the way along with CPI release which could adjust the decision making. A weak CPI will send the USD and yields lower but any shock to the upside will not be welcomed.

During the week we also have ECB and BoJ policy announcements along with GDP from the UK and New Zealand.

Weekly Majors Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post Quieter Week After Debt Ceiling. CPI & FED Now on The Radar first appeared on trademakers.

The post Quieter Week After Debt Ceiling. CPI & FED Now on The Radar first appeared on JP Fund Services.

The post Quieter Week After Debt Ceiling. CPI & FED Now on The Radar appeared first on JP Fund Services.