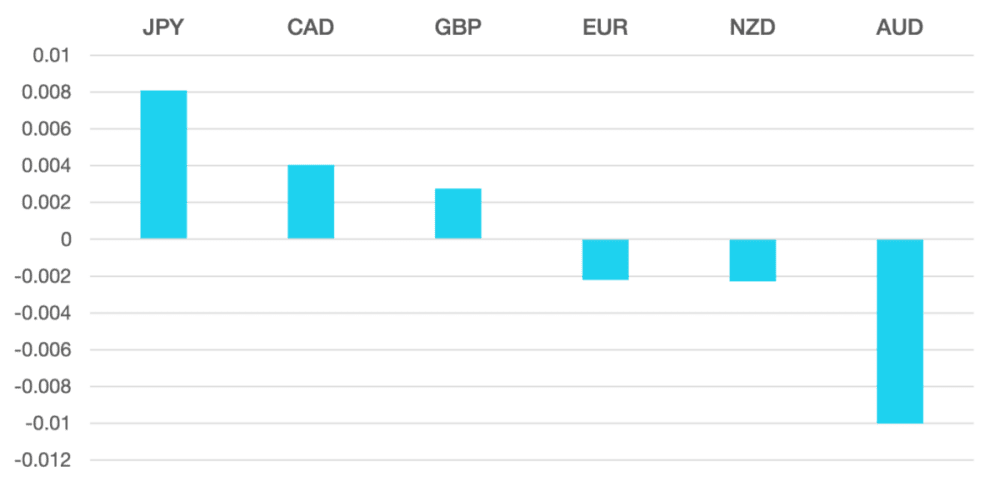

Last week the markets were influenced by impending rate cuts or lack of. GBP regained the 1.27 level as any imminent rate cuts seem to have been pushed back from June to the earliest August. This was substantiated by the most recent inflationary numbers coupled with the unexpected election in July.

The DXY ended the week 0.2% better closing around 104.75. Despite the small move the USD was underpinned by the market moving away from the anticipated rate cut for September. With hawkish tones from the FOMC minutes and robust economic data the chances of a September rate cut have fallen further.

Euro had a good week as once again interest rates led the way. The ECB are looking for a June cut but beyond that the tone is one of wait and see.

Oil gave back its previous weeks gain falling around 2.2% to close just below $78 per barrel.

Next week we will get the US GFP and inflation data which should give a clearer picture to the market for how the Fed may react in the coming months.

Weekly Majors’ Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post Rate Cuts Looking Deferred first appeared on trademakers.

The post Rate Cuts Looking Deferred first appeared on JP Fund Services.

The post Rate Cuts Looking Deferred appeared first on JP Fund Services.