Last week we had a slew of data from the US. We saw the CPI data print lower than expected which although was only a slight miss the market took a large reaction to.

The market is no longer pricing in any further rate rises in the US and cuts are now more expected in 2024.

The Dollar reversed significantly during the week. The DXY losing almost 2% to close below 104.

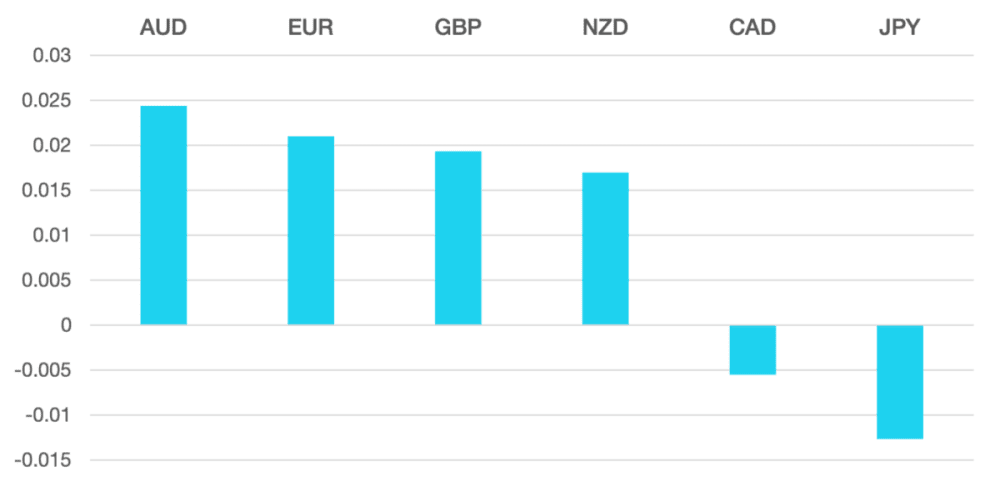

The Euro had a good week as did the GBP, but both gains were based on the USD loss rather than anything from the regions. The eurozone data sprung little surprises as did the UK with only inflation numbers in the UK nudging lower. Both the EUR and GBP gained around 2% vs the USD.

Commodity currencies finally had a good week. The weakening dollar helped along with lowering yields during the week. CAD rallied just 0.5% as oil prices continued to weaken but both NZD and AUD were winners gaining around 2.5% each.

Oil continued to slide losing a further 1.6% to close just above $76.

The week ahead will keep the US Dollar in focus as it remains the main driver. With the market looking towards to the ~Fed and if it has indeed completed its rate rise cycle.

For data it is a quieter week with GDP from Germany and PMI releases.

Weekly Majors Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post Rate Cuts on The Horizon first appeared on trademakers.

The post Rate Cuts on The Horizon first appeared on JP Fund Services.

The post Rate Cuts on The Horizon appeared first on JP Fund Services.