Last week we saw large swings as a large risk off move rocked all markets. The US employment NFP Numbers came in weaker than expected which led to a large sell off. This led to a global sell off in equities which could move into Asia on Monday.

The Fed is now coming under increasing pressure to make their move and lower interest rates. Speculation is growing that they will not wait till the next meeting but will in fact make a rate cut in the next 7 – 10 days. Post payrolls the evidence suggests that the US economy is heading towards rescission or even a hard landing which could further perpetuate risk off trading.

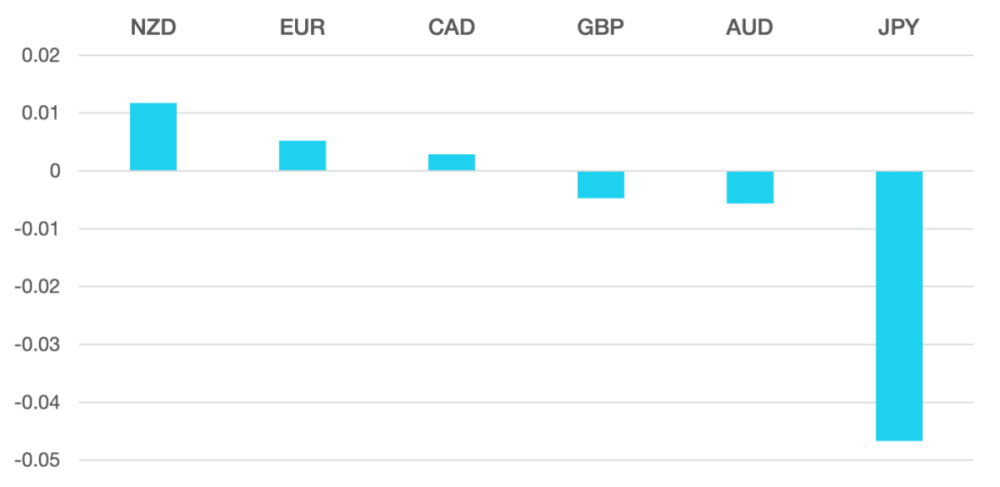

JPY was the clear winner here as safe haven coupled with a decision to raise interest rates. Additionally, the BoJ announced plans to reduce Government Bond Purchases. This led the Yen to a very strong rally gaining almost 5%.

Despite the turmoil both GBP and EUR had a mid-range week. GBP lost post BoE and its decision to cut rates for the first time. The dovish comments will put any upside lid on the GBP. conversely EUR gained on the week with a stronger than expected GDP and CPI numbers lifting the EUR.

Oil was under pressure all week as general risk assets fell. The WTI fell 3% which is its 4th losing week on the trot.

The week ahead will volatile. The spill over from Friday into Asia could lead to further risk off trading.

We have RBA interest rates and global PMI numbers.

Weekly Majors’ Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs. The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post Recession fears rise pressure on the Fed? first appeared on trademakers.

The post Recession fears rise pressure on the Fed? first appeared on JP Fund Services.

The post Recession fears rise pressure on the Fed? appeared first on JP Fund Services.

Peyman Khosravani is a global blockchain and digital transformation expert with a passion for marketing, futuristic ideas, analytics insights, startup businesses, and effective communications. He has extensive experience in blockchain and DeFi projects and is committed to using technology to bring justice and fairness to society and promote freedom. Peyman has worked with international organizations to improve digital transformation strategies and data-gathering strategies that help identify customer touchpoints and sources of data that tell the story of what is happening. With his expertise in blockchain, digital transformation, marketing, analytics insights, startup businesses, and effective communications, Peyman is dedicated to helping businesses succeed in the digital age. He believes that technology can be used as a tool for positive change in the world.