The Digital Transformation of Chemicals and Materials research outlines use cases already in practice in facets of the chemicals and materials industry and a vision for how digital technologies and digital transformation out of them will reshape the chemicals and materials landscape in the coming decades.

The chemicals and materials industry has mostly seen only incremental innovation in recent decades, with growth coming primarily from expansion into new geographic markets, and very little from product innovation. At the same time, there is additional pressure on the industry with consumers demanding increased personalization, sustainability, and efficiency, which has forced the chemicals and materials industry to innovate its business practices.

In the new report “The Digital Transformation of Chemicals and Materials,” Lux Research outlines use cases already in practice in facets of the chemicals and materials industry and a vision for how digital technologies and digital transformation out of them will reshape the chemicals and materials landscape in the coming decades.

The chemicals and materials industry has entered a difficult phase of its history. While the second half of the 20th century saw a flurry of breakthrough innovations in chemistry, in recent decades, chemical breakthroughs have proven more elusive, replaced instead by incremental innovations. Correspondingly, much of the growth for chemicals and materials companies today is born of expansion into new geographic markets and carefully crafted mergers and acquisitions that make for more efficient operations, rather than the launch of new products.

On top of this shift, new pressures are also challenging the industry. Customer expectations are changing, and today’s customers demand a more convenient customer experience and products customized to their needs. Investor and customer pressure and regional policies push chemicals and materials companies to improve the sustainability of the materials they develop and their operations, especially in the economy post COVID-19.

The industrial workforce is aging, creating human resources challenges. And revenue is under threat as well, as sustainability concerns and new technologies drive more efficient use of resources and raw materials that threatens the industry’s traditionally volume-based business model.

“The era of business process-driven innovation is one of tight competition, and not just in the characteristics of the products themselves – chemicals and materials companies are also competing on the customer experience and their ability to keep prices low by improving their operations,” explains Katrina Westerhof, director of research at Lux. “Digital transformation can not only strengthen a company’s position in product, customer experience, and profitability but also unlock new capabilities that completely change the nature of what a chemicals company is and does.”

Key Takeaways

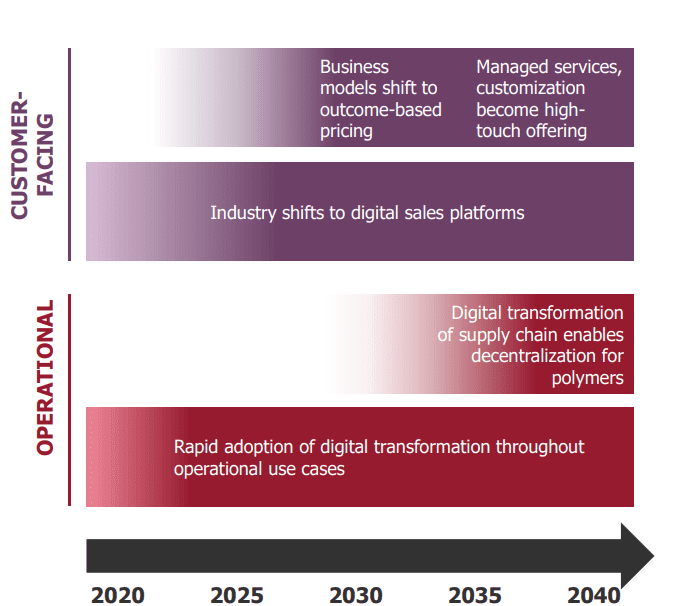

· In both operational and customer-facing functions, the chemicals and materials industry is already benefiting substantially from digital transformation across product development, supply chain, manufacturing, and sales and post-sales support.

· Business model transformation will be a key result of digital transformation, as digital technologies enable outcome-based pricing and layered services over the coming two decades.

· Although the industry has unique drivers and constraints, technologies and use cases from industries like pharma, logistics, and consumer goods will find a home in chemicals and materials.

Over the next 20 years, more than $500 billion of the $2.8 trillion chemicals and materials market will transition to outcome-based business models. Digital technologies like sensors, computer vision, analytics, and robotics will be key enablers of that transition.

“Four key areas emerge as focal points for digital transformation in the chemical industry: product development, supply chain, manufacturing, and sales or post-sales support,” states Shriram Ramanathan, Ph.D., director of research at Lux and a key contributor to the report.

“Use cases in product development include identifying innovation trends, designing new materials or synthesis pathways, and lab automation,” adds Ramanathan. “For example, AI can be used to design new materials formulations or chemical structures that can speed up product development, or identify new synthesis pathways that enhance the sustainability of materials. Automation can streamline and speed up research, all of which adds to both top-line and bottom-line growth in this highly competitive industry.”

“We predict that over the next few years, digital transformation in the materials and chemicals industries will pick up quickly, leading to a large increase in use cases. In the short term, those use cases will exist in pockets and will largely focus on improving operational efficiencies, such as via lab automation, production optimization, asset tracking, and digital sales platforms,” says Ramanathan.

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals