One of the biggest discussion points in the wealth management industry at the moment is what the impact will be of robo advisors on traditional wealth management firms. Driving this debate to a whole new level was the recent purchase of FutureAdvisor by Black Rock in 2015. Black Rock is a traditional player, and FutureAdvisor is a US based robo advisor. Writing for the Financial Times, Chris Flood (2015) points out that it:

“… might seem a miniscule financial transaction for the world’s largest asset manager, but it is a potentially huge deal for the wealth management industry.”

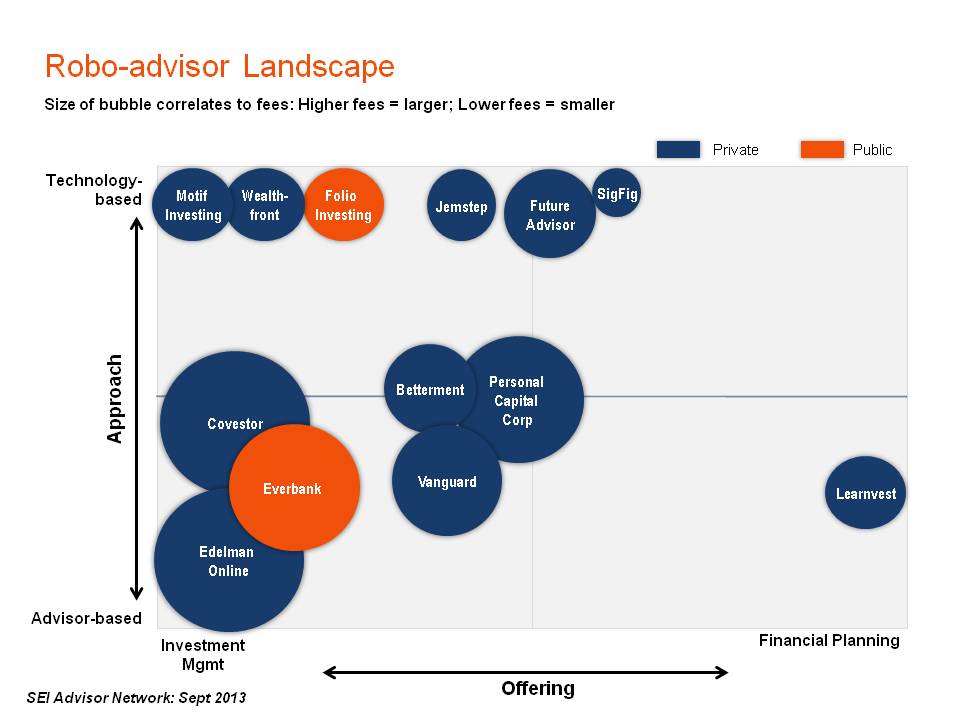

It is possible that all providers, including financial advisors, fund managers, brokers and banks face a huge threat from robo advisors. Robo advisors challenge traditional models of wealth management, as they offer services that are based online and are delivered in an automated manner. This cuts down on costs for such firms as they do not have to hire so many people.

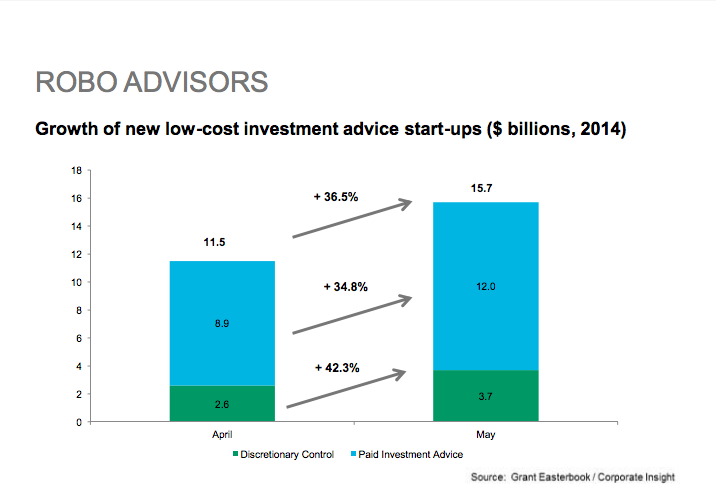

It is reported that the industry is in the very early stages of development, but is gaining steam at a tremendous pace. For example, studies show that there are in excess of 200 robo advisor platforms in the USA alone. There are also companies in Europe already too. Aside from the Black Rock acquisition, there have been a number of other high profile deals. For example, Aberdeen Asset Management purchased a company that manages £1.5 billion, known as Parmenion Capital Partners. Nutmeg was not bought out, but only a stake, not the whole company.

Source: Investors still prefer human advisors over computers, Wealth Management

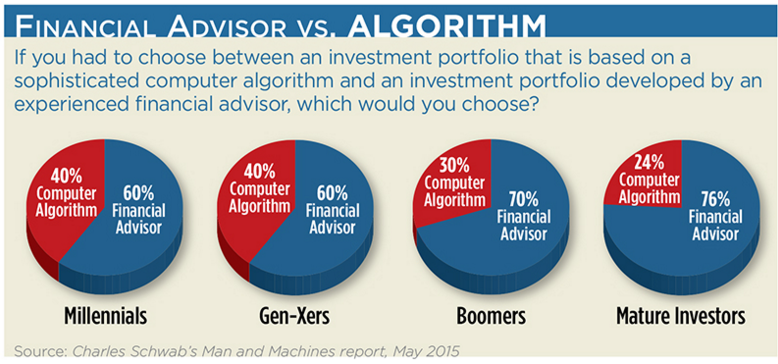

Some are very cynical about the robo advisor industry and believe that it does not stand a chance of going anywhere. Yet others believe it will be extremely profitable. Citigroup in particular has projected potential growth to possible reach $5 trillion over the upcoming ten years. This is argued to be likely as a result of younger investors starting to use these types of services. Instead of selling to Baby Boomers and Generation X, wealth management firms will have to sell to millennials. Millennials are known for loving to do stuff through their computers. This is where robo advisors might win out.

Source: Morningstar

Not everyone has a full belief in the robo advisor segment making such large waves in the market. Others are placing their bets on a different kind of model, the hybrid. The hybrid model offered is basically a robo advisor that provides a variety of different online ETF services for users. However, the advantage that organisations with these models believe that they have is that people do sometimes like to talk to actual people when making investments. The model provides this opportunity for people to do so. Vanguard is an example of a company that is offering such an option. It is reported that this has been particularly popular already, and that $21 billion in assets has been attracted through this mixed approach.

All of this represents a considerable shift in the industry, one that Flood has suggested may be “seismic” based on the comments of a senior analyst at consultancy firm Celent. It is argued that there will still be in-person demand for activities such as retirement planning and tax advice, but that some activities may be more likely to move online through robo advisor uptake. While others believe that robo advisors have considerable opportunities for improvement, it is possible with the type of investment that they have been getting, they will indeed be able to do this. This development could really shake up the market.

However, it is likely that the market for traditional wealth management firms will not disappear completely. After all, people are different. Some like communicating face to face, and some prefer using online tools. This means that the seismic shift may not be as dramatic as some think. Robo advisors are currently managing very small amounts in comparison to large wealth management firms that are well established names in the sector. Robo advisors have a long way to go before they achieve such a profile. Is the future really bleak for traditional wealth management firms, or will robo advisors die out before they really make a massive impact? The reality probably lies somewhere between these two positions.

Relevant posts:

How Wealth Management responds to Robo Advisors

The Emergence of Robo Advisors

Paula Newton is a business writer, editor and management consultant with extensive experience writing and consulting for both start-ups and long established companies. She has ten years management and leadership experience gained at BSkyB in London and Viva Travel Guides in Quito, Ecuador, giving her a depth of insight into innovation in international business. With an MBA from the University of Hull and many years of experience running her own business consultancy, Paula’s background allows her to connect with a diverse range of clients, including cutting edge technology and web-based start-ups but also multinationals in need of assistance. Paula has played a defining role in shaping organizational strategy for a wide range of different organizations, including for-profit, NGOs and charities. Paula has also served on the Board of Directors for the South American Explorers Club in Quito, Ecuador.