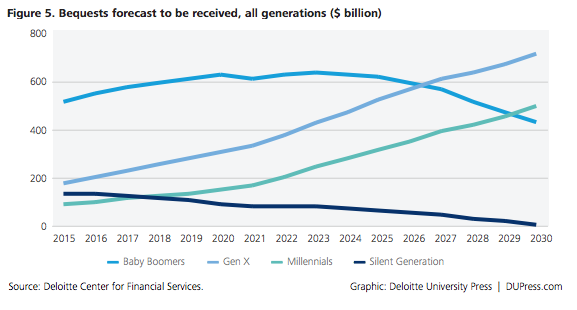

Recently Deloitte carried out a study into generational wealth, looking at how wealth may shift between the generations over the upcoming 15 years. The study was carried out by Val Srinivas and Urval Goradia in 2015. This three part series reports on the findings of the Deloitte research, with each part focusing on a different generation: Baby Boomers, Generation X and Millennials.

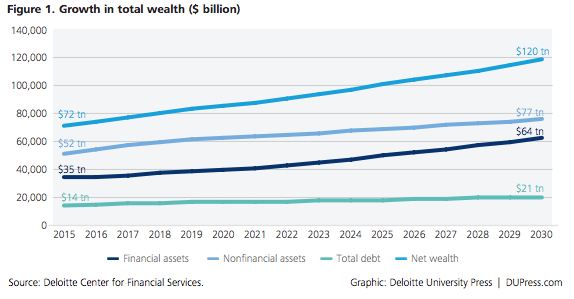

Wealth is growing in the USA. As explained by Deloitte, it is estimated that:

“US household assets will increase from $87 trillion today to over $140 trillion by 2030, of which nearly $64 trillion will be in investable financial assets.”

This is important because it means the wealth management market has the potential to grab up anywhere between $150 and $240 billion in fees for wealth management services. Deloitte felt that understanding this by generation would be important to see the differences in behaviour between the different generations, which impacts what they are interested in.

Baby Boomers – Who are they?

Baby Boomers are defined as those that were born between 1946 and 1964 and as of 2015 they are aged 51 to 69. Generation X was born between 1965 and 1980 and in 2015 they are aged between 35 and 50. The Millennial Generation was born from 1981 to 1997 and in 2015 they are aged between 18 and 34. This part will focus on Baby Boomers. There are estimated to be more than 61 million Baby Boomers as of 2029, comprising 17.2% of the US population.

The Deloitte report found that Baby Boomers are likely to remain the most wealthy in the USA up until 2030. It is reported that Baby Boomers are likely to continue being financial services customers at a minimum up until 2030, since by that time there will be 60 million of them between 66 and 84. These people are vast in numbers and have tremendous wealth, and as such it is anticipated they will be at the peak of wealth rankings for the generations.

Baby Boomers’ Wealth

According to Deloitte, Baby Boomers will have financial assets worth almost $26 trillion by 2029, which will be a massive increase from the 2015 figure of $17 trillion. It is anticipated that between now and 2029, younger people in the Baby Boomer age group will carry on gaining financial assets between now and their retirement. Equally however, it is believed that by 2030 their assets will start to “taper off”. The reasons for this are cited as being higher death rates and asset decumulation. What all of this is reported to indicate is that Baby Boomers need to continue to be a focus for financial services firms, since they reportedly control 70% of all disposable income in the USA. Clearly a move away from them would be foolhardy. However, they will start to accumulate assets less slowly than other generations over the next few years. That is because as they hit retirement there will be a bigger focus on spending their financial assets rather than accumulating them. Minnesota Estate planning services in particular are considered to be important, and it is stated that technological solutions are also of interest to this group.

Why are Baby Boomers wealthy?

The Deloitte report concurs with findings from other sources. As Emily Brandon (2008) for US News reported, the Baby Boomers are extremely wealthy and this is down to three main factors relating to their generation.

- Their generation is much larger than that before it and of that which came after it as well.

- Meanwhile, the introduction of women into the Baby Boomer workforce was fundamental to this change. What this means is that more Baby Boomers were wage earners compared to the total population than their predecessors – social change in this regard had a major role to play.

- Not only that but Baby Boomers had a higher level of education compared with earlier generations.

However, it is argued that Baby Boomers still need to work hard to make sure they have sufficient savings and that they are prepared for retirement, as not all in the Baby Boomer generation are. Nonetheless, it can be seen that the Baby Boomer generation is doing well compared to the generation which came before it, so it certainly is not all bad.

Paula Newton is a business writer, editor and management consultant with extensive experience writing and consulting for both start-ups and long established companies. She has ten years management and leadership experience gained at BSkyB in London and Viva Travel Guides in Quito, Ecuador, giving her a depth of insight into innovation in international business. With an MBA from the University of Hull and many years of experience running her own business consultancy, Paula’s background allows her to connect with a diverse range of clients, including cutting edge technology and web-based start-ups but also multinationals in need of assistance. Paula has played a defining role in shaping organizational strategy for a wide range of different organizations, including for-profit, NGOs and charities. Paula has also served on the Board of Directors for the South American Explorers Club in Quito, Ecuador.