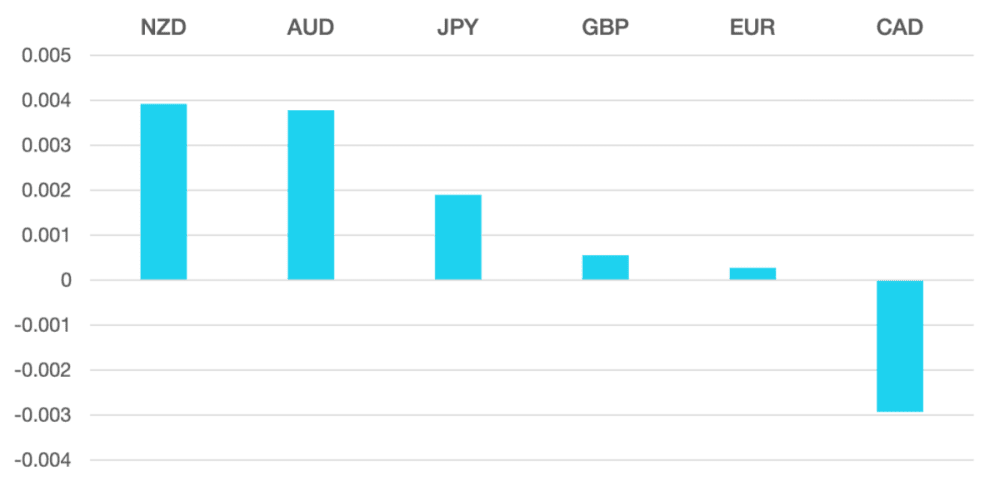

Last week the markets were muted despite inflationary data remaining stubbornly high. AUD and NZD were the winners following strong numbers but the real risk off sentiment for the week muted any major moves.

The DXY ended the week flat as it failed to show any strength. The Fed pushing any cuts back further into 2024 is now priced in and with any lack of new information the greenback failed to make any moves.

Euro struggled post May inflation data which gave a higher reading than expected. ECB rate cut for June could still happen and the market will be anticipating the ECB this week. Should they cut analysts are only expecting 1 further cut in 2024 as opposed to 2 before the inflation data.

Oil had a quiet week falling just 0.8% to close just above $77.

This week we have the ECB and BoC rate announcements where both are expected to cut along with a range of PMI numbers.

Friday, we have the obligatory NFP numbers.

Weekly Majors’ Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post Risk of sentiment mutes any positive moves first appeared on trademakers.

The post Risk of sentiment mutes any positive moves first appeared on JP Fund Services.

The post Risk of sentiment mutes any positive moves appeared first on JP Fund Services.