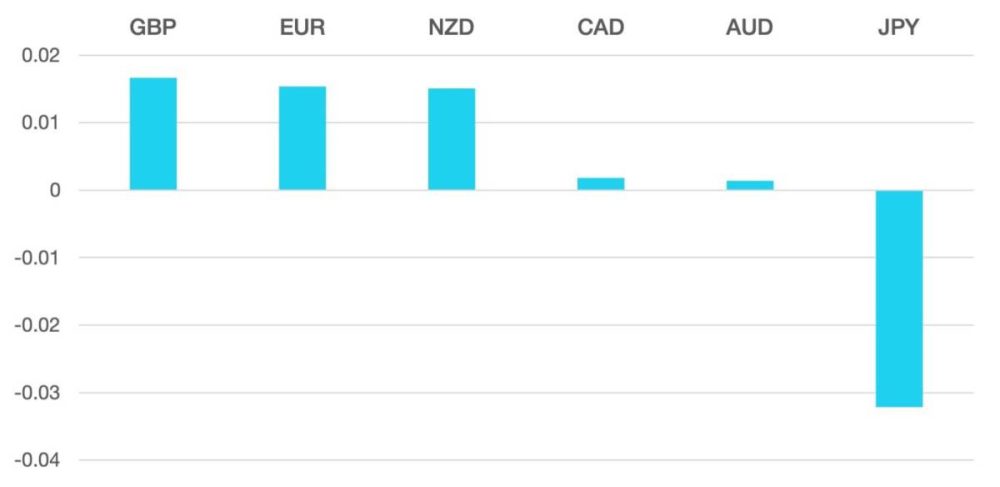

Last week the US Dollar finally showed some weakness as it lost ground against all major currencies. JPY was the standout performer as it gained after the BoJ began speaking about potential rate rises on the horizon.

As mentioned above the JPY was the standout performer. With thanksgiving on Thursday, the Yen posted a 3% move as it headed towards the 150 level. We would expect the move to continue sub 150 and with the BoJ talking up potential rate hikes and eyes moving towards the December Fed meeting this could be a move to watch.

Both GBP and EUR remained in their broad range for the week. Both maintained gains vs the weak US Dollar but when looked at vs other pairs the currencies did not register any real gains.

Risk currencies ignored the falling Oil price as they posted a positive week. NZD ended the week around 1.5% higher vs the US Dollar despite the expected 50bps rate cut by the RBNZ.

Oil reversed much of the previous weeks gain and looks to be heading back to the support area of the long-term range. WTI last week fell 4% to end the week just about the $68 level.

The week ahead we still see the markets in the throws of the Trump Trade. This is pushing equities and crypto to new highs.

Data wise we have a busy week rounded off by the Non-Farm Payrolls.

Weekly Majors’ Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs. The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post Risk on Continues first appeared on trademakers.

The post Risk on Continues first appeared on JP Fund Services.

The post Risk on Continues appeared first on JP Fund Services.