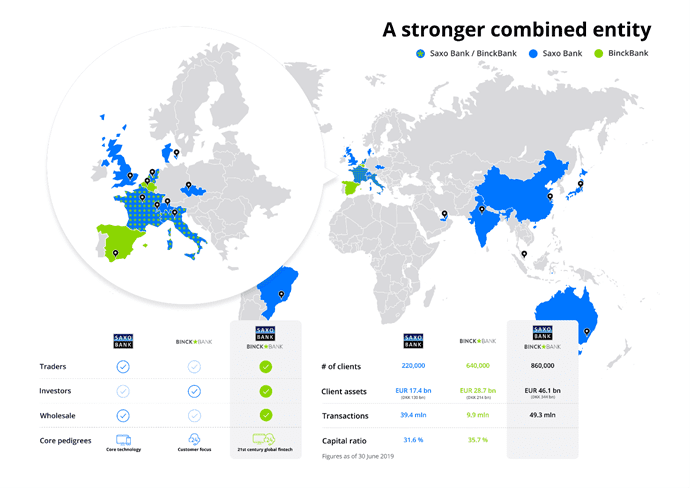

Saxo Bank and BinckBank has announced that Saxo Bank has finally completed the acquisition of BinckBank. The acquisition of online bank BinckBank marks an important milestone for the Saxo Bank Group that now services approximately 860,000 clients and holds approximately EUR 46 billion in client assets. By gaining scale and reducing cost and complexity, the Group can continue its ambitious investments in the digital client experience and expand its product offering, delivering more relevant and intuitive platforms and services. Clients and partners will significantly benefit from being serviced by a much larger Group with enhanced resources and capabilities for innovation and development.

Saxo Bank and BinckBank will now start working on the integration of the two companies to share technology infrastructure and add additional products and services to offer an optimal SaxoExperience. The integration will naturally take some time, and developments and improvements will be communicated on an ongoing basis.

Commenting on this significant milestone, Kim Fournais, CEO and founder of Saxo Bank, said: “We are very pleased to have completed the acquisition of BinckBank with strong shareholder support and regulatory approvals. The acquisition is a win-win for all parties, clients, employees, shareholders and the societies we operate in. By joining forces, we have what it takes to become the leading global provider of state-of-the-art multi-asset trading and investment solutions – truly democratising trading and investment.”

Fournais also pointed out that the investment and trading industry is undergoing a major transformation facing new regulation, rising expectations for better digital client experience, ongoing margin compression and a great need for multi-asset trading capabilities. These trends call for scale, and the successful acquisition of BinckBank is a quantum leap forward in terms of creating scale which is crucial for our long-term success.

“We are pleased to welcome the talented employees of BinckBank in the Saxo Group and we will together work relentlessly to offer clients a market leading client experience. Today is the first page of a new promising chapter and together we have exciting times ahead,” he added.

On the other hand, Vincent Germyns, CEO of BinckBank mentioned: “Today represents an important milestone towards BinckBank’s twentieth anniversary. Strong support from both shareholders and regulators shows that we made the right decision to join forces. BinckBank and Saxo Bank are working closely together on the way forward since the announcement of the takeover bid in December 2018. Our starting point was and remains the achievement of optimum customer benefits.”

The CEO believes that now it is full steam ahead in delivering the ultimate digital customer experience in order to continuously help them in realising their financial ambitions. “Thanks to Saxo Bank we can further expand our product range and offer more intuitive platforms in the future. That is how our customers will benefit from Saxo Bank’s leading position in trading and investment technology and services. Finally, I would like to thank our shareholders, customers, employees and of course Saxo Bank for their trust,” he concluded.

As of the settlement, Saxo Bank holds shares representing approximately 95.14% of the aggregate issued and outstanding share capital of BinckBank on a fully diluted basis.

The BinckBank shares which were not yet tendered on 31 July 2019 can be tendered during the post-closing acceptance period, which started Thursday 1 August 2019 and will end at 17:40 (CET) on Wednesday 14 August 2019. Saxo Bank and BinckBank intend to procure the delisting of the BinckBank shares on Euronext Amsterdam as soon as possible. Saxo Bank intends to initiate the statutory buy-out procedure in an expeditious manner. Reference is made to the joint press release dated 31 July 2019 as published by BinckBank and Saxo Bank.

As of settlement the changes to the composition of the supervisory board of BinckBank, as approved by the general meeting of BinckBank on 23 April 2019, have become effective. The supervisory board of BinckBank is now composed of: Mr. J.W.T. van der Steen (Chairman), Mr. J.G. Princen, Mr. S. Kyhl, Mr. S. Blaafalk and Mr. F. Reisbøl.

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals