The Irreversible Game Change

Disruption is one of the keywords of the 21st century. It is in the DNA of human society. It is a catalyst in the ecosystem of social behaviour, financial transactions, and, increasingly, the dialectics of technology, of which social media is a recent mutation. Disruption manifests acutely in the financial trading industry, creating continual breaks in continuity and transformations of the status quo, acccelerated by technology in general, and social media in particular.

“There is nothing new under the sun,” says the Bible. But from time to time there are upheavals that accelerate unforseen change. Our current challenge is that these changes are now occurring every couple of months. This relentless change and mutation creates a new landscape that requires accelarated adaptation and innovation for organizations to survive.

The financial and social media industries have experienced a break from what we might think of as narrative continuity. In coming years, the pace will quicken and spread, as traditionally static organisations like financial institutions become more technology- and social media- driven.

It is increasingly likely that social media will play a growing role in the operation of financial markets. While this idea raised conservative eyebrows when it was first introduced, it is now accepted as part of the dominant model: adapt or die. Technology and software have replaced conventional modes of transaction. The new paradigm, wrought by the emergence of social media and its disruptive footprint, has become the rule.

Initially perceived as frivolous and consumer-oriented, social media has subsumed important financial processes with its sentiment-tracking, data-collection, real-time responsiveness.

If many within the finance industry felt that social media had little to offer to the serious trader, any credible financial player must now become fully versed in social media, prepared to assimilate its continuos beta operation and disruptive innovation. As social media has become increasingly woven into the fabric of everyday lives through mobile and other platforms, the finance industry has begun to wake up to its vast potential and 360-degree ecosystem.

Trust: The Future of the Finance and Investment Industry

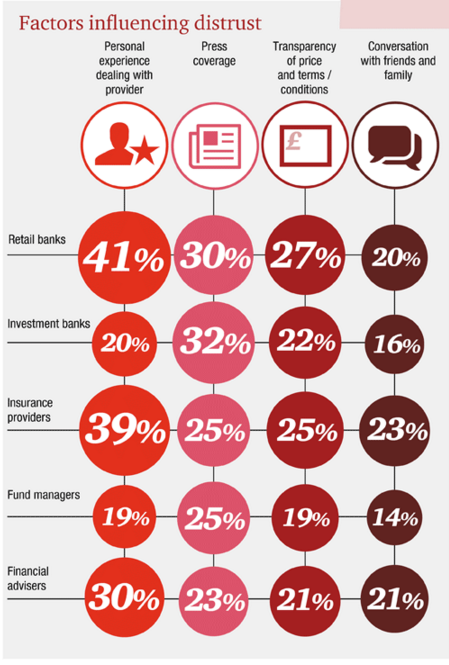

The creation of trust is the key for the financial industry in a landscape of ongoing financial crisis.

A major assets in any industry is trust, but even more so in the financial and trading industry. As the economy goes through bear and bull cycles, the emergence of advanced technologies, exempliflied by the current cycle of social media applications, become a means to an end. As disruption increaslingly and continually reconfigures the industry’s very DNA, there is a countervailing need to promote stability. In this fragile environment, the financial and trading industry must focus its efforts on building trust in order to develop and improve its performance and results.

“One of the most important assets destroyed by the continuing financial crisis cannot be found in any standard national account statistics or economic models. Nevertheless, it is an indispensable premise for every single transaction in any industry worldwide. That asset is Trust…. Trust above all has to be regained in order to stimulate the securities markets and, consequently, reflate the European economies. The most promising way of helping investors to regain trust is to give them a good reason to do so: with trading conditions which guarantee integrity, stability, safety, neutrality and transparency.” –Michael Krogmann, Deutsch Borse AG in The Euromoney Future of the Financial Markets Handbook, 2008/10

The industry must also focus its energies on the real goal of finance and trading – managing and facilitating strong relations with customers, providing the best services, and creating a solid long-term relationship with the economy. In short, it must reestablish trust with both clients and the economy as a whole. The industry likewise needs to focus on the new ecosystem the online environment of big data and digital identity promoting best practices for Internet and social media applications and using technology resources to better serve and engage customers. By catering to its clients through powerful new social media tools, the industry empowers both itself and its clients by cutting out the middle man. The industry must remain committed to value creation, while cultivating relationships with organisations that leverage innovation without the loss traditional continuity.

The future of the financial, trading, and investment industry hinges on how well it helps people manage their personal finances and investments through service solutions, budgeting, and spending trackers, among other services, while offering stability, safety, neutrality, and complete transparency. There is no way around this.

Although the interaction between the financial industry and the rest of the economy is complex and has in recent years undergone a dramatic erosion, the financial and trading industry cannot work in isolation. As an example, economic growth during the 1960s was exceptional, but it seemed to require little financial intermediation. On the other hand, finance grew quickly in the 1980s, while the economy stagnated. The pattern changed again in the 1990s. Now, in the 2000s, the disconnect and disparity between the financial industry and the larger economy has The core focus of financial institutions is to provide services to customers, irrespective of whether they are households, investors, traders, entrepreneurs, governments, or corporations. The financial sector’s share of aggregate income reveals the value that the rest of the economy attaches to these services. Trust encourages steady investment, enabling the financial sector to grow its share of income and become a barmometer of larger economic health.

Related Posts

Fintech: The Financial Sector Disrupter

How deep is crisis of trust in financial services industry Part 2

How deep is crisis of trust in financial services industry Part 1

Social Media and Fintech Trends for the Hedge Fund Industry

The Future of Funds and The Alternative Investment Industry Video

Dinis Guarda is an author, academic, influencer, serial entrepreneur and leader in 4IR, AI, Fintech, digital transformation and Blockchain. With over two decades of experience in international business, C level positions and digital transformation, Dinis has worked with new tech, cryptocurrencies, drive ICOs, regulation, compliance, legal international processes, and has created a bank, and been involved in the inception of some of the top 100 digital currencies.

Dinis has created various companies such as Ztudium tech platform a digital and blockchain startup that created the software Blockimpact (sold to Glance Technologies Inc) and founder and publisher of intelligenthq.com, hedgethink.com, fashionabc.org and tradersdna.com. Dinis is also the co-founder of techabc and citiesabc, a digital transformation platform to empower, guide and index cities through 4IR based technologies like blockchain, AI, IoT, etc.

He has been working with the likes of UN / UNITAR, UNESCO, European Space Agency, Davos WEF, Philips, Saxo Bank, Mastercard, Barclays and governments all over the world.

He has been a guest lecturer at Copenhagen Business School, Group INSEEC/Monaco University, where he coordinates executive Masters and MBAs.

As an author, Dinis Guarda published the book 4IR: AI, Blockchain, FinTech, IoT, Reinventing a Nation in 2019. His upcoming book, titled 4IR Magna Carta Cities ABC: A tech AI blockchain 4IR Smart Cities Data Research Charter of Liberties for our humanity is due to be published in 2020.

He is ranked as one of the most influential people in Blockchain in the world by Right Relevance as well as being listed in Cointelegraph’s Top People In Blockchain and Rise Global’s The Artificial Intelligence Power 100. He was also listed as one of the 100 B2B Thought Leaders and Influencers to Follow in 2020 by Thinkers360.