Last week we expected the markets to be all about the data.

We had the Fed speaking early in the week which continued the higher for longer theme and the hotly anticipated monthly payrolls were due Friday. However, all this was outshone by the news that SVB bank was collapsing. This pushed a panic button sending risk assets tumbling lower as the contagion risk was being assessed.

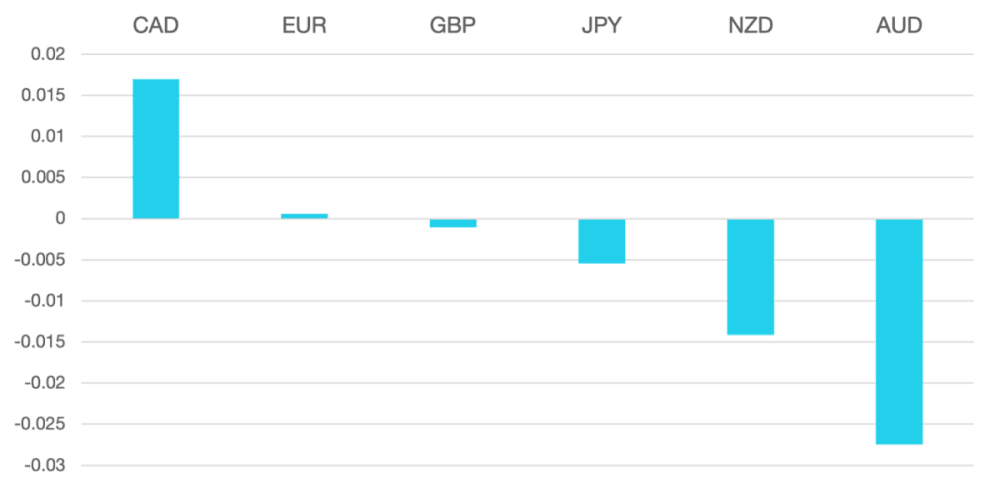

The Euro and GBP did very little as the SVB unfolded with both currencies ending the week flat vs the US Dollar. The worst of the damage was done in risk currencies. ZND and CAD both fell around 1.5% whilst the AUD and NOK fared much worse paring around 2.5% on the week.

Oil reversed on the previous week and fell naturally with the much broader risk off move. WTI fell 4.2% to close around the $76.5 level.

The week ahead will be looking at the weekend and how the unfolding SVB story is handled. A quick move by the Fed and Treasury will bolster markets for Monday but the fallout from this could reach far and wide with many tech companies moving assets

Data wise we have US CPI and ECB rates highlighting the week.

Weekly Majors Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post SVB Outshines Payrolls first appeared on trademakers.

The post SVB Outshines Payrolls first appeared on JP Fund Services.

The post SVB Outshines Payrolls appeared first on JP Fund Services.