Tag: hedge funds

Hedge Funds Research: Quant Strategies on the Rise as Post Pandemic...

New research with 100 leading hedge fund managers reveals widespread enthusiasm for quant strategies.

• 80% of hedge fund managers expect institutional investors to increase...

Hedge Fund CFOs Predict That Cryptos Will Account For 7% Of...

Predicted crypto exposure highest among North American CFOs at 11% and lowest in Asia at 5%

Over half (52%) of North American CFOs...

Gibraltar Cemented as a Preferred Jurisdiction for Crypto Hedge Funds

Report by PwC and Elwood confirms Gibraltar as a jurisdiction of choice for hedge funds, backed up by leading fintech lawyers from ISOLAS LLP.The third...

Are L/Sequity Managers Playing The European Recovery?

We find that L/S Equity managers focusing on Europe are becoming more optimistic, but in a cautious way.

Economic prospects in Europe are noticeably improving....

Hedge Funds Lag Peers In ESG Factor Portfolio Integration According To...

· Only 7% of investors report their hedge funds managers currently offer “high integration” of ESG principles in their investment process.

· 64% of asset...

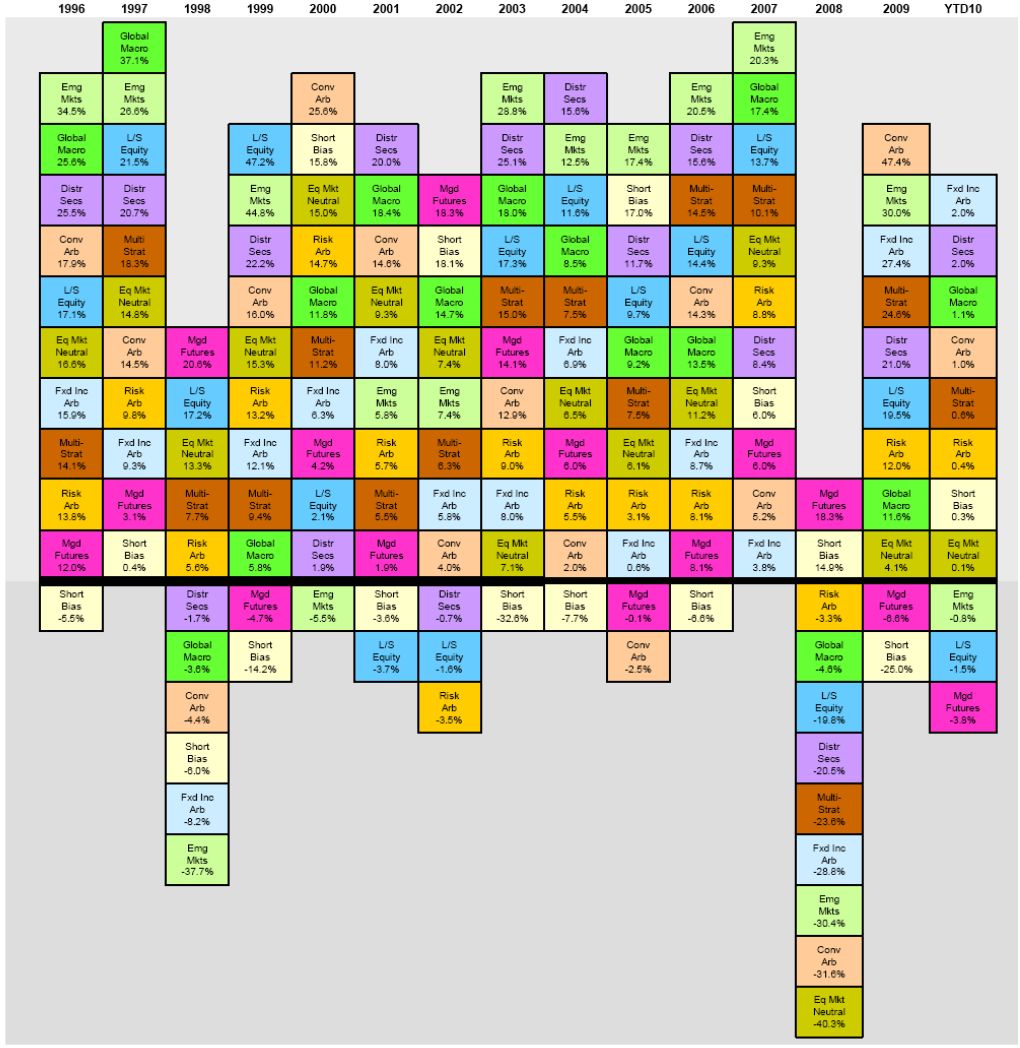

Trends in Demand for Hedge Fund Strategies

The hedge fund industry is dynamic, comprising of numerous strategies that attract varying degrees of interest over time. Demand for each strategy is impacted...

Top Hedge Fund Industry Trends for 2021

Below is Agecroft Partners’ 12th annual predictions for the biggest trends in the hedge fund industry for 2021. These predictions are based on the...

Hedge Funds Losing Millions Annually As Manual Processes And Old Technology...

Hedge Funds are absorbing a punishing $8 million annual hit to their Assets Under Management (AUM) due to high levels of manual processes and...

Hedge Fund’s Mid-Year Trends and Strategies Currently In Demand

The hedge fund industry is dynamic, comprising numerous strategies that attract varying degrees of interest over time. Demand for each strategy is impacted by...

Hedge Fund Indices: A Helpful Tool, But Can Cause Confusion

Although hedge fund indices can be a very useful tool, indices can also create confusion if their construction and composition are not well understood.

Take...

Tips to Maximize your Savings: Choosing the Best Savings Account

Most people that open a bank account know little about the financial services out there. Often, we opt to default the savings (or other)...

What You Will Get from Your Auto Insurance in 2020

When you buy a new car you will want to protect your investment. Taking out an auto insurance policy is one way to do...

Artificial Intelligence Startups Raised $61.6bn in Total Funding, a 35% Jump...

Technologies like artificial intelligence and machine learning have transformed business processes across different industries, changing how companies operate, manage finances, gather and analyze data,...

How Do You Select a Long/Short Equity Hedge Fund Manager?

The long short equity manager universe is highly fragmented. Investors can increase the probability of achieving higher returns if they focus on managers concentrated...

Evolution of the Hedge Fund Industry Since 2008

Although the hedge fund industry net-flows will hold up much better in 2020 in comparison to what was experienced in 2008, the impact on...

Massive Dislocations In The Fixed Income Marketplace Creates Opportunities For Top...

The massive dislocations in the fixed income markets in March caused huge divergence in performance among hedge fund managers with similar strategies. The first...

CTA’S “Positively Skewed” Performance Helps Reduce Tail Risk in a Diversified...

Commodity Trading Advisors (CTAs) are one of only a few hedge fund strategies that performed well throughout the market selloffs of 2000-2002, 2008 and...

Crypto Hedge Funds: Common Issues You Need To Know Before Investing

A hedge fund is an investment in a vast group of essential securities that are governed by a team of professional investors who continuously...

Branding Dominates Hedge Fund Flows

Over the past decade, a vast majority of hedge fund net asset flows have gone to a small minority of hedge funds with the...

Shrinking Hedge Fund Fees: Evolution And What Investors Need To Know

Hedge funds fees remain under extreme pressure across the industry. This strong trend is driven by declining return expectations from investors, increased competition across...

Top Hedge Fund Industry Trends

• One of the Hedge fund trends is that assets under management will grow for the 11th time in 12 years.

• Overall revenue will...

Missing the Mark: The CFA Institute Releases Hedge Fund Performance Standards

By Donald A. Steinbrugge, Founder and CEO Agecroft Partners, LLC

The CFA Institute has released and circulated the final version of its guidelines to improve performance...

Hedge Fund Performance Returns To Positive Ground

After dipping into the red last month, the global hedge fund industry returned to positive territory in June with an aggregate industry performance of...

In-Depth: Major Discrepancies In Hedge Fund Performance Reporting – Part 2,...

By Donald A. Steinbrugge, CFA – Founder and CEO, Agecroft Partners

As we thoroughly mentioned in the first part of this in-depth article, the Chartered Financial...

In-Depth: Major Discrepancies In Hedge Fund Performance Reporting – Part 1

By Donald A. Steinbrugge, CFA – Founder and CEO, Agecroft Partners

The Chartered Financial Analyst Institute (CFA), one of the most important organizations in...