Almost 80 percent of financial institutions have entered into fintech partnerships. At the same time, global venture capital (VC) investment in fintech reached $30.8 billion in 2018, up from just $1.8 billion back in 2011. Technology is expected to play a critical role in the financial industry of today and these are the ten trends that are shaping Fintech according to ‘Synergy and disruption: Ten trends shaping fintech’ research by McKinsey.

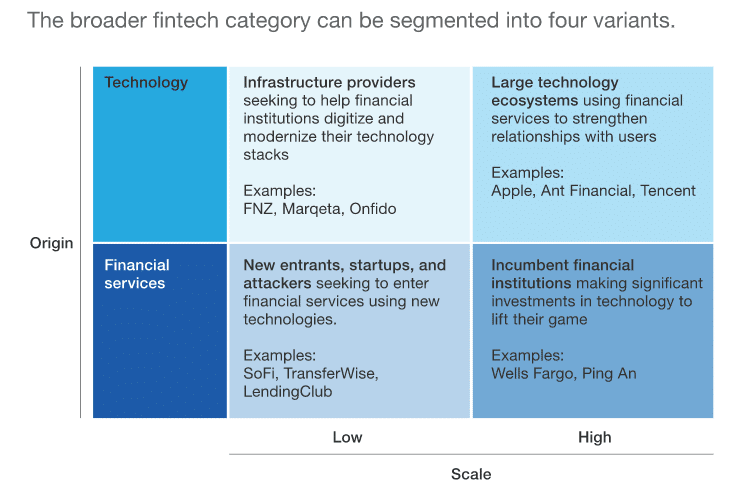

When we talk about Fintech companies, we are actually referring to a range of different models: four variants to be exact. There are Fintechs as new entrants, start-ups, and attackers which seek to build economic models similar to those of banks; Fintech companies that are seen as incumbent financial institutions investing significantly in technology to improve performance. There are also Fintechs as ecosystems orchestrated by large technology companies which offer financial services both to enhance existing platforms, like e-commerce platforms developing their own payments methods; and Fintechs as infrastructure providers, which are specialized in selling services to financial institutions.

All these fintech companies, however they come from the financial industry or elsewhere, face risks when entering the over-competitive current financial landscape, and they need to account for all the synergies and disruptions that incumbents and attackers have to deal with – and adapt to. McKinsey has gathered the ten trends from all those synergies and disruptions that are shaping the Fintech ecosystem.

McKinsey’s Ten Trends Shaping Fintech

1. High level of regional variation in fintech disruption

As per the research, winners in fintech are primarily emerging at a regional rather than global level, similar to traditional retail banking. Regulatory complexity within countries and across regions is contributing to regional “winner take most” outcomes for disrupters. Firms need to invest more in regional compliance rather than launching a global effort on day one. That is why to successfully enter new markets, they must adapt to new sets of market dynamics and government regulations and select new markets based on a clear understanding of regional variations.

2. AI is a meaningful evolution, not a great leap forward for fintechs

The buzz surrounding artificial intelligence (AI) applications in fintech is intense, but to date few standalone use cases have been scaled and monetized. “Rather, we see more advanced modeling techniques, such as machine learning, supplementing traditional analytics in fintech. While AI shows great promise, it is likely to be more of an evolution than a great leap forward into new data sources and methods,” was said in the research.

3. Good execution and solid business models can trump exotic technology

The most successful fintechs have evolved into execution machines that rapidly deliver innovative products, with dynamic digital marketing campaigns to match. Notably, winning start-ups often succeed without using completely new technology. Data-driven iteration, coupled with early and continuous user testing, has led to robust product-to-market fit for these firms.

One good example would be that of TransferWise. The company’s great user experience and distinctive marketing campaigns allowed it to grow rapidly, enabling it to successfully disrupt the space, and to report £117 million in revenues in March 2018.

4. Scrutiny of business fundamentals is increasing as funding grows more selective

“Years into the fintech boom, after many highs and lows, investors are becoming more selective,” was stated by McKinsey. “While overall funding remains at historically high levels, technology investors globally are increasingly investing in proven, later-stage companies that have shown promise in attaining meaningful scale and profits. Data compiled by PitchBook show that despite a clear increase in total VC funding, investments in early-stage fintechs decreased by more than half from a peak of more than 13,000 deals in 2014, to around 6,000 in 2017. The bar for funding is quickly rising, and companies with no clear path to monetization are going to have a harder time meeting it.”

5. Great user experience is no longer enough

Back when banks had cumbersome websites that didn’t render on mobile, it was easy for fintechs to win over customers by building a half-decent app with a great user experience (UX). Today, most financial institutions have transformed their retail user experience, offering full mobile functionality with best-in-class design principles. Great UX is now the norm. Customers, as a result, require more reasons to switch to new fintech offerings.

6. Incumbents can, and do, strike back

In general, incumbents were initially slow to respond directly to fintech attackers, perhaps for fear of cannibalizing strong legacy franchises. “Many started by trialing digital offerings in non-core businesses or geographical areas, where they could take more risks. Retail banks have led the charge in upgrading digital experiences to match fintech in their core banking products. For example, Wells Fargo recently added a predictive banking feature that analyzes account information and customer actions to provide tailored financial guidance and insights, with over 50 types of prompts,” according to McKinsey

7. More attackers and incumbents are partnering

An increasing number of incumbents and fintechs are realizing the benefits of combining strengths in partnership models. As they reach saturation point in their native digital marketing channels, many fintechs are now actively looking for partnerships to grow their business. They bring to the table their higher speed and risk tolerance, and flexibility in reacting to market changes. Larger ecosystem firms also bring broad and sticky customer bases from their core internet businesses.

8. Infrastructure fintechs: Potential is high, sales cycles are long

“Like a giant tower of Jenga pieces, an enterprise’s legacy IT stack has many building blocks, some purchased off-the-shelf and some developed in-house,” was again seen on the research. And it added that as in Jenga, removing or replacing “pieces” of the IT stack can be risky and complicated. Digital innovation is often hindered by legacy IT, particularly the core banking system (CBS), and the costs of changes are high.

9. There is a tentative return to public markets

As fintechs mature, at some point they must decide whether to go public. While both investors and employees require a path to liquidity, many fintech founder-CEOs have preferred to stay in the private market to avoid the burdens of public listings—as well as the batterings received by other fintechs that tested the IPO market.

10. Chinese fintech ecosystems have scaled and innovated faster than their counterparts in the West

China’s fintech ecosystems are structurally different from their counterparts in the US and Europe. Outside China, the most successful fintechs are typically attackers that have focused on one vertical, such as payments, lending, or wealth management, deepening their core offering and then expanding geographically. “In the US, for example, PayPal and Stripe focus mainly on online payments; Betterment and Wealthfront offer digital wealth management; and LendingClub and Affirm are alternative lenders—all proven strategies,” the research concluded.

All these ten trends must be addressed by all fintech players, because Fintech has evolved considerably in the last few years and continues to change rapidly. “We believe the future will develop in different ways for these varying types of fintechs, and that they will face very different hurdles. For instance, while infrastructure providers will often succeed or fail based on product or technical capabilities, consumer-oriented start-ups most commonly grapple with customer acquisition costs,” was mentioned in the McKinsey research.

Other hurdles include established technology players entering the fintech ecosystem, which may struggle to shift from traditional mindsets and operating models to deliver digital journeys at a start-up pace. Furthermore, regulatory challenges may prove an issue in the short term. The “move fast and break things” approach that disrupted the advertising industry is unlikely to be tolerated in financial services. And concerns about monopolistic behavior could well prevent Western tech giants from developing the sort of integrated financial services offerings we see from Ant Financial or Tencent in China.

“With large technology companies knocking at their doors, incumbent financial institutions should proactively engage with fintech disruption, whether by building their own capabilities or by partnering or acquiring. For fintech attackers and infrastructure providers, the road to success is not easy. As the fintech markets mature, firms from the four categories of fintechs will compete directly in some cases, and join forces in others,” concluded the report.

Peyman Khosravani is a global blockchain and digital transformation expert with a passion for marketing, futuristic ideas, analytics insights, startup businesses, and effective communications. He has extensive experience in blockchain and DeFi projects and is committed to using technology to bring justice and fairness to society and promote freedom. Peyman has worked with international organizations to improve digital transformation strategies and data-gathering strategies that help identify customer touchpoints and sources of data that tell the story of what is happening. With his expertise in blockchain, digital transformation, marketing, analytics insights, startup businesses, and effective communications, Peyman is dedicated to helping businesses succeed in the digital age. He believes that technology can be used as a tool for positive change in the world.