Hedge funds have had a fascinating history of ups and downs. The object of huge press attention when their performance levels are through the roof – but also vilified intensely when they fail, hedge funds today remain popular investment mechanisms that have changed remarkably since their initial development in the 1940s.

Birth of the Hedge Fund

It will come as no surprise to learn that the very first hedge funds came about in a time of growing prosperity. During the US bull market of the 1920s, many private investment vehicles were available to wealthy investors. Of these early pooled investment vehicles, Warren Buffet cites the Graham-Newman Partnership, founded by Benjamin Graham and Jerry Newman, as one o the very earliest early hedge funds.

Alfred Jones – Hedge Fund Pioneer

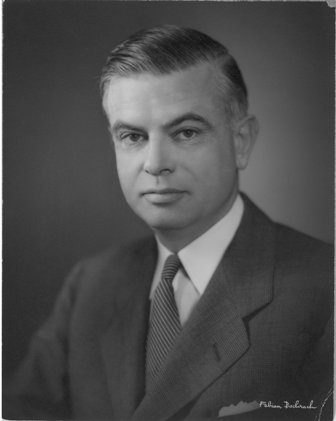

A sociologist named Alfred Jones is credited with having coined the phrase “hedged fund”. The son of American parents, Jones was born in 1901 in Melbourne, Australia. Moving to the US as a family while he was still a young child, he went on to graduate from Harvard in 1923. By the early 1930s Jones was working as an American diplomat in Berlin, Germany. He then earned himself a sociology PhD at Columbia University before joining the editorial staff at Fortune magazine in the early 1940s.

Fortune magazine would turn out to be the making of Jones’ own fortune when, in 1948, he was asked to write an article about current investment trends. His research prompted him to try his own hand managing money. Putting up $40,000 of his own money, he raised a total of $100,000, and then sought about trying to minimise the risk in holding long-term stock positions by short selling other stocks. This makes Jones one of the forerunners in investment innovation, essentially using what has now come to be known as a classic model of investment – the long/short equities model. To enhance returns further, he also used leverage.

But Jones’ innovations wouldn’t stop there. In 1952, he changed the structure of his investment vehicle. The managing partner would now receive a 20% incentive fee as compensation as the vehicle was converted from a general partnership to a limited partnership. This made Jones the first money manager to combine the use of leverage, short selling, shared risk through a partnership with other investors, as well as a means of compensation based on investment performance. And so this is why Jones is so often credited as being the true hedge fund pioneer.

Other articles in this series:

The History of Hedge Funds: Part 2

The History of Hedge Funds: Part 3

I am a writer based in London, specialising in finance, trading, investment, and forex. Aside from the articles and content I write for IntelligentHQ, I also write for euroinvestor.com, and I have also written educational trading and investment guides for various websites including tradingquarter.com. Before specialising in finance, I worked as a writer for various digital marketing firms, specialising in online SEO-friendly content. I grew up in Aberdeen, Scotland, and I have an MA in English Literature from the University of Glasgow and I am a lead musician in a band. You can find me on twitter @pmilne100.