The Rise of the Hedge Fund

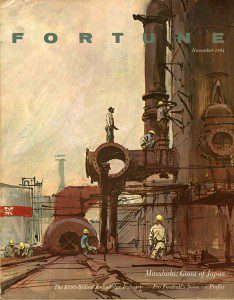

It would be more than a decade after Alfred Jones’ invention of the hedge fund that they would truly take off as a major investment vehicle. Again, Fortune magazine holds a place in the story.

In 1966, it published an article that shone a spotlight on an obscure investment that has somehow managed to outperform every mutual fund on the market by double-digit figures over the past year. The investment had also outperformed the mutuals by high double-digits over the last five years. Money managers and investors sat up and took notice, and for the first time hedge funds became a real industry. Just two years later, there were 140 hedge funds in operation.

Bursting the Hedge Fund Bubble

The recession of 196970 and the 19731974 stock market crash were not kind to hedge funds. It didnt help that by this time many funds had turned their back on Jones original strategy a combination of hedging and stock picking, and instead had tried to maximise returns by engaging in riskier strategies based on long-term leverage. As a result, many fund suffered heavy losses during the 69-70 and 73-74 bear markets.

Making a comeback

Hedge funds would remain somewhat out of favour for the next 20 years. All that would change in 1986 however, when an article appeared in Institutional Investor. This time, the spotlight was on Julian Robertsons Tiger Fund and its phenomenal double-digit success.

Julian Robertson started the Tiger fund in 1980 with $8 million in start-up capital. By the late 1990s – the peak of this fund’s performance, the fund was worth over $22 bilion, and by 1993 he was estimated to have made $300 million personally from the fund. Speaking about his approach to investing, Robertson has been quoted as saying:

“our mandate is to find the 200 best companies in the world and invest in them, and find the 200 worst companies in the world and go short on them. If the 200 best don’t do better than the 200 worst, you should probably be in another business.”

Inspired by the performance of this high-flying hedge fund, investors once again became enamoured with an industry that was flourishing. This time around, hedge funds offered a far wider scope of strategies than ever before from derivatives, such as futures and options, to currency trading.

Other articles in this series:

The History of Hedge Funds: Part 1

The History of Hedge Funds: Part 3

I am a writer based in London, specialising in finance, trading, investment, and forex. Aside from the articles and content I write for IntelligentHQ, I also write for euroinvestor.com, and I have also written educational trading and investment guides for various websites including tradingquarter.com. Before specialising in finance, I worked as a writer for various digital marketing firms, specialising in online SEO-friendly content. I grew up in Aberdeen, Scotland, and I have an MA in English Literature from the University of Glasgow and I am a lead musician in a band. You can find me on twitter @pmilne100.