5: George Soros – Soros Fund Management LLC

Earnings: $1.1 billion

Hedge fund legends don’t come much bigger than George Soros, who is still going strong at the age of 82. The former chief of the legendary Quantum Fund currently serves as the chairman of Soros Fund Management, which has $24 billion under management including his own personal fortune and that of his charitable foundations, which support a range of good causes such as human rights, public health, and education. Day-to-day operations at the firm are overseen by CIO Scott Bessent, but Soros remains actively involved. The firm scored big in 2012 with a successful large bet against the yen, reminiscent of some of Soros’ most famous trades. While the performance of his funds came in below the US stock market in 2012, a substantial profit was still made.

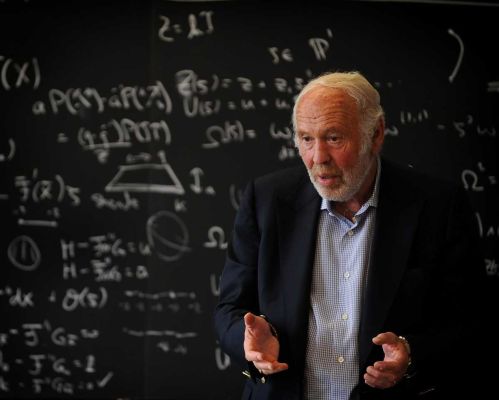

4: James Simons – Renaissance Technologies Corp.

Earnings: $1.3 billion

The man known as the Quant King retired from day-to-day involvement in his $20 billion hedge firm, Renaissance Technologies, in 2010, but continues to play an active role in the firm at 74. The jewel in the Renaissance crown is a secretive, consistently profitable auto-trading strategy known as Medallion, but not all of their funds performed that well in 2012 and two even made a loss. Having graduated with a degree in mathematics from MIT, Simons went on to work as a code breaker for the US military during the Vietnam War, and later headed up the math department at SUNY-Stony Brook. He founded Renaissance in 1982, and the company, which is based in East Setauket, New York, uses computer modelling to identify inefficiencies in highly liquid securities. Aside from his involvement with the firm, Simons has his own charitable foundation to support scientific and mathematical research, the Simons Foundation, to which he has contributed over $1billion of his personal wealth. He also chairs the Math for America programme, and is a highly visible supporter of autism research.

3: Steven Cohen – SAC Capital Advisors

Earnings: $1.3 billion

Despite being hit with a $1.2 billion fine for insider trading, Steven Cohen continues to be one of the most successful investors in the hedge fund universe. His firm, SAC Capital Advisors, has over $14 billion under management, and posted gross returns of around 25% in 2012. After charging his famously high fees, the net return of around 13% wasn’t high enough to beat the US stock market, but was still a lot better than most hedge funds managed that year.

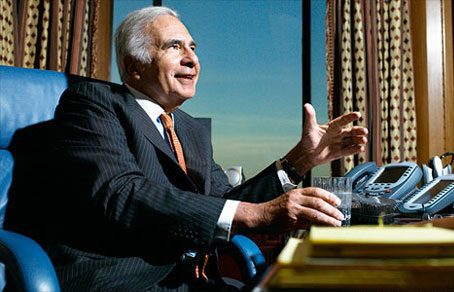

2: Carl Icahn – Icahn Capital

Earnings: $1.9 billion

77-year-old Icahn continues to be one of the hedge fund industry’s leading lights, with a phenomenal 28% return in 2012, better than the US stock market and just about every other hedge fund. His big winners for the year were large bets on CVR Energy and Hain Celestial Group.

1: David Tepper – Appaloosa Management

Earnings: $2.2 billion

Although he might not be as much of a household name as George Soros or Ray Dalio, David Tepper is without a doubt one of the all-time greats of the hedge fund industry, and enjoyed a bumper year in 2012. In a year when most hedge funds failed to beat the US stock market, Tepper’s Appaloosa Management smashed it with well-timed bets on stocks and other securities. With net returns of nearly 30%, he outperformed every other hedge fund manager in the world in 2012, and even more remarkably, his $15 billion fund has been posting similar returns since 1993. Aside from his investment activities, he has been focused on his philanthropic efforts such as donating to food banks in his native New Jersey and sponsoring educational programmes such as Teach for America.

Other articles in this series:

The Top 10 Hedge Fund Managers – Part 1

I am a writer based in London, specialising in finance, trading, investment, and forex. Aside from the articles and content I write for IntelligentHQ, I also write for euroinvestor.com, and I have also written educational trading and investment guides for various websites including tradingquarter.com. Before specialising in finance, I worked as a writer for various digital marketing firms, specialising in online SEO-friendly content. I grew up in Aberdeen, Scotland, and I have an MA in English Literature from the University of Glasgow and I am a lead musician in a band. You can find me on twitter @pmilne100.