While traditional banking and new financial technology solutions are starting to understand that collaboration might be the better follow-up strategy to achieve long-term goals, there are big tech firms that are taking advantage of that yet-to-be-completed partnership. And as such, they have begun to offer financial services through their wide-spread and well-established networks. Amazon and Alibaba are the two major players offering these kind of financial solutions to the millions of customers they already reach.

Just to glimpse the importance in terms of market penetration and sells worldwide, Alibaba did $31 Billion in sales on Single’s day, and Amazon had its best sales in history through the 2018 thanksgiving period with 180 Million transactions. Amazon, on the other hand, haven’t announced exact sales revenues, but using Statista’s average online transaction size in 2017 of $81, their total sales could have been $15 Billion.

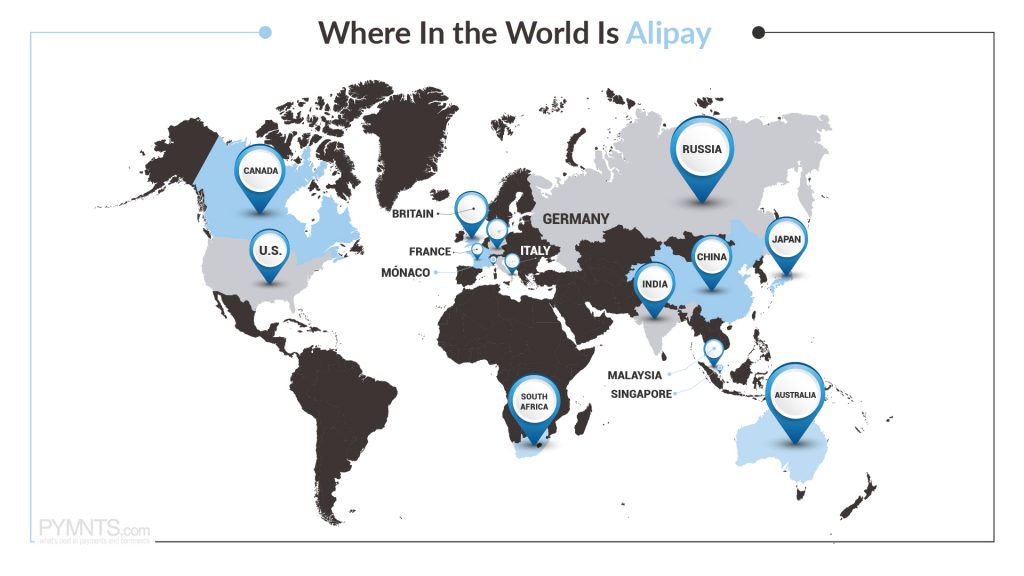

Furthermore, Arunkumar Krishnakumar, from DailyFintech, goes even further when he mentioned that only in 2017 the number of Alipay users were 400 Million compared to Amazons 33 Million users, and as of September 2018, there were 520 Million Alipay users.

And although this not necessarily means better financial solutions penetration as their main business are based on e-commerce, they have the advantage of operating through payment systems, online and with millions of customers already within their networks. Given that vantage point they operate from, their financial services are more likely to success than any other starting company.

For instance, the battle is up and the winner is yet to be disclosed. Especially when one of the main Techfin solutions in today’s financial landscape come from payment systems. In that regard, comparing transaction sizes is almost meaningless, as Alipay is light years ahead.

In fact, Jack Ma, technology visionary and co-founder and executive chairman of Alibaba Group, already had in mind plans to take their business beyond purely commercial endeavours and spoke loud about their plans for Alibaba to start offering TechFin solutions:

There are two big opportunities in the future financial industry. One is online banking, where all the financial institutions go online; the other is internet finance, which is purely led by outsiders. – Jack Ma

However, Amazon still seems to have the upper hand in terms of user’s reach. As mentioned by Mr Krishnakumar, “Amazon definitely have the global advantage. As of 2017 they had 2 Billion visitors per month, whereas Alibaba was at about 900 Million visitors per month. And all this with just 55% internet penetration in China (vs 78% in the US), with Alipay conquering 54% of China’s mobile payments.

If payment services that the largest Techfin in the West does, is about 10% of that of the largest Techfin (of the East), it should give a perspective of what it means to other ancillary Financial Services such as lending, insurance etc.,” the expert continued, “And if that is the comparison between the US and China, UK and European Fintechs perhaps won’t even come close.”

In both instances, success of these organizations in finance will be based on the ability for the institution to collect and analyze massive data sets, learn from the insights to improve personalization and digital engagement in real-time, and expand offerings in response to their consumer needs.

TechFin and New Financial Solutions

What Amazon and Alibaba are battling for is what experts call Techfin, the next step in financial technology. Although it is a sort of natural evolution from recent years’ financial technology solutions, it goes beyond what current Fintech startups and banks provide to offer a whole array of new services within different sectors, not only those specifically coming from the financial spectrum.

As recently written by Fintech expert Jim Marous on Forbes, the difference between fintech and techfin is based on the origin of the underlying organization. Fintech usually references an organization where financial services are delivered through a better experience using digital technologies to reduce costs, increase revenue and remove friction.”

“A basic example of a fintech offering is the mobile banking services that most traditional banks offer. More commonly, fintech refers to non-traditional financial offerings such as PayPal, Zelle and Venmo in the U.S. and digital-only Starling Bank, Monzo and Revolut in the U.K,” the expert said.

Alternatively, as Mr Marous pointed out, techfin usually references a technology firm that finds a better way to deliver financial products as part of a broader offering of services. Examples of techfin companies include Google, the already mentioned Amazon, Facebook and Apple (GAFA) in the U.S. and Baidu, Alibaba & Tencent (BAT) in China.

Hernaldo Turrillo is a writer and author specialised in innovation, AI, DLT, SMEs, trading, investing and new trends in technology and business. He has been working for ztudium group since 2017. He is the editor of openbusinesscouncil.org, tradersdna.com, hedgethink.com, and writes regularly for intelligenthq.com, socialmediacouncil.eu. Hernaldo was born in Spain and finally settled in London, United Kingdom, after a few years of personal growth. Hernaldo finished his Journalism bachelor degree in the University of Seville, Spain, and began working as reporter in the newspaper, Europa Sur, writing about Politics and Society. He also worked as community manager and marketing advisor in Los Barrios, Spain. Innovation, technology, politics and economy are his main interests, with special focus on new trends and ethical projects. He enjoys finding himself getting lost in words, explaining what he understands from the world and helping others. Besides a journalist he is also a thinker and proactive in digital transformation strategies. Knowledge and ideas have no limits.