The Distributed Futures research programme has produced a report entitled “The Economic Impact of Smart Ledgers On World Trade”, the latest in a series of exciting projects in the programme. We are delighted to invite you to the formal report launch and discussion on Thursday 19 April, from 08:45 to 10.45. This event will be an opportunity for you to join the discussion on the findings of the report, which is intended to inform policy makers and business people making decisions about moving towards Smart Ledgers.

The report features a description of the econometric approach, which maps trade frictions that Smart Ledger technology might be able to offset, especially in the realm of non-tariff and bureaucratic barriers to trade. The report also includes the results of a global survey of 247 contract and commercial managers, which focused on their awareness and use of Smart Ledgers, the importance they attach to various aspects, and the areas of ‘pain’ that could be relieved by the adoption of Smart Ledger technology. There are some truly insightful results.

The report highlights the importance of the World Trading system which “creates and channels wealth and prosperity throughout the world. An efficient and effective global trading system allows goods and services to flow to where they are needed most, through price signalling. In turn, trade generates value through economies of scale and specialisation. International trade allows countries to exploit economies of scale by producing for a bigger mass market than would be achievable domestically. The efficiency gains are then transferred to consumers through lower prices. Other economic benefits are channelled to workers through higher salaries.”

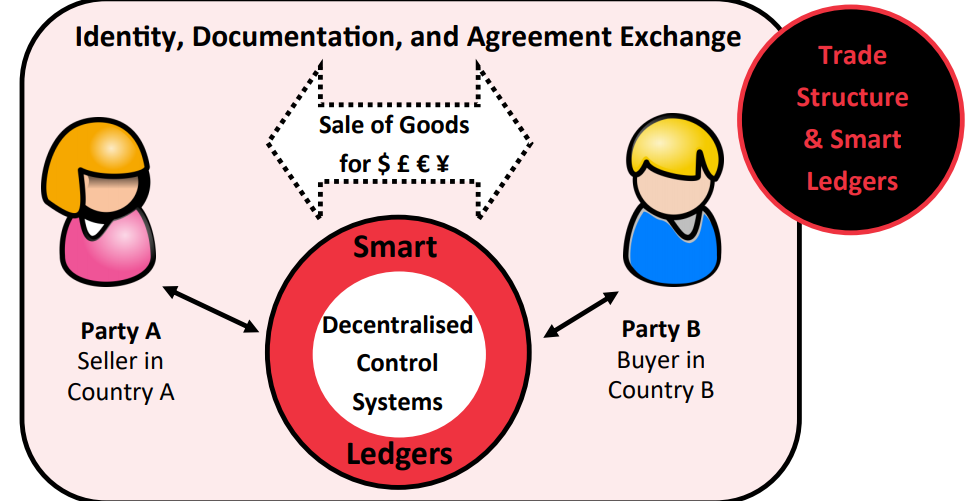

In that context, Smart Ledger can aim World Trade as Smart Ledgers are mutual distributed ledgers (MDLs, aka blockchains) with embedded, executable code. MDLs are multi-organisational databases with a super-audit trail that rely on cryptography to ensure their functionality and integrity, as well as to control viewing permissions.

Smart Ledgers are able to specify rules about the use of data within the MDL, for example “release this ship’s location four hours after it has been recorded on the MDL.”

International trade is an area where Smart Ledger technology could have tangible, practical applications.

An inside of the full report can be seen here, while the official launch will take place in an even in London next Thursday, 19 April at 08:45 under the name of Report Launch: The Economic Impact of Smart Ledgers On World Trade

AGENDA

- 08:45 – Registration opens

- 09:00 – Introduction & background, by Professor Michael Mainelli, Executive Chairman, Z/Yen Group

- 09:15 – “The Economic Impact Of Smart Ledgers On World Trade”: Report walkthrough from Cebr (Graham Brough, Cristian Niculescu-Marcu, Beatriz Cruz)

- 10:00 – Panel discussion and questions

- 10:40 – Formal Close

To assist to the even, please register here.

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals