Security Tokens is a big, complex subject that requires legal, technical and commercial knowledge. The technology is already here. The need has been here for a while (entrepreneurs want an easier way to raise early stage capital). With the crazy ICO market of 2017, the pendulum swung too far in the opposite direction, making it a lousy deal for investors and in many cases an illegal transaction. Maybe with Security Tokens we get the balance about right – quick easy capital raising that is legal and with adequate protections for investors. What is needed to make that happen is a) easier compliance with securities regulations b) an ecosystem of service providers who will help investors to separate the wheat from the chaff (find the quality offerings). That is more about law and finance than technology, although the tech platform that empowers those securities lawyers and finance engineers will likely become dominant.

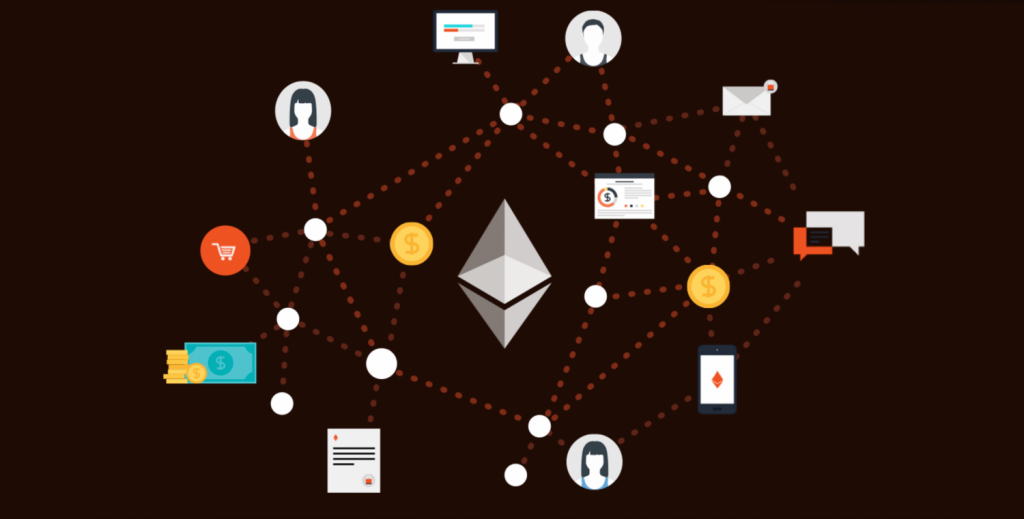

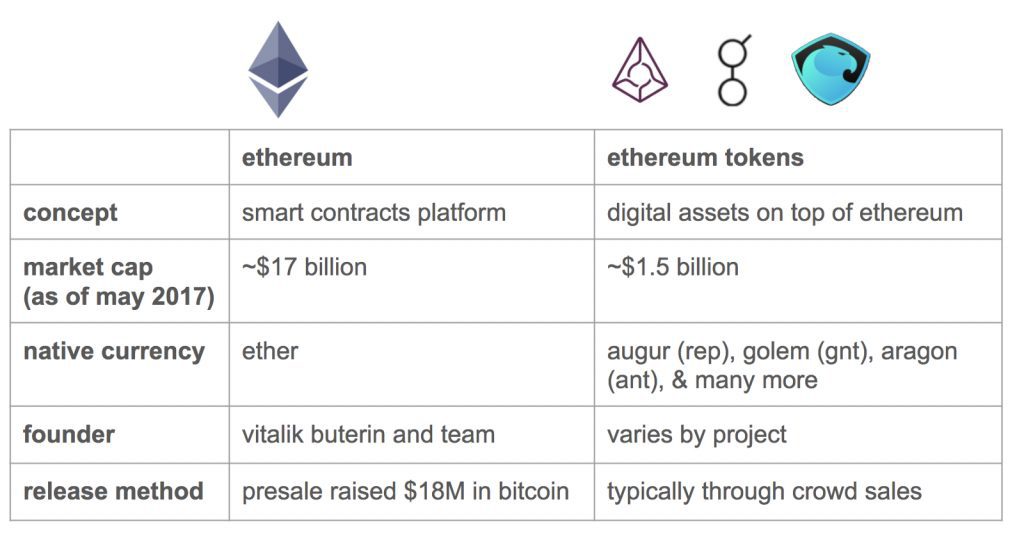

Bitcoin is an electronic currency built on blockchain, secured by cryptography. Ethereum is an open-source, public, decentralized platform on the blockchain supporting the deployment of centralized applications. Ethereum was created in 2015 by former Bitcoin Magazine co-founder, Vitalik Buterin, and Gavin Wood.

Ethereum was built as a decentralized platform for the sole purpose to construct an electronic currency, which anyone could use. Early adopters suddenly discovered by late 2016 that tokens could be created on Ethereum. Now in 2018, a revolution is underway to tokenize all types of the trillions of dollars of assets, from pure financial assets (equity, debt, derivatives) to real estate to paintings to intangibles like copyrights by creating and exchanging tokens having the characteristics of securities. The revolution is being waged by finance engineers, securities lawyers and blockchain technologists.

Ethereum innovated “smart contracts”. Smart contracts are computer protocols that define the terms governing contracts and automatically enforce contracts in effecting transactions over the blockchain, creating certainty, transparency, decentralization and disintermediation of facilitators like legal advisors, notaries, escrow agents. “Decentralized applications” now provide for payment, operational crowdfunding platforms, gambling, and identity verification systems. The “Ethereum Virtual Machine” is a runtime environment for smart contracts – a giant environment a giant environment for building bigger and more powerful smart contracts – allowing any user or developer to create applications.

Once security tokens are created or issued, the main principle is ownership: the purchase and exchange. Thus the era of security tokens spawned by technological innovation is largely the domain of financial actors, and, accordingly, subject to the regulation of financial services, the most stringently regulated industry in all countries. Many industry experts estimate the development of tokenized securities now commencing is an elemental mix of 20% technology innovation and 80% regulatory compliance innovation.

Todays’ security token issuing platforms primarily run on Ethereum, such as Polymath, providing end-to-end processing including management of the security tokens. The Issuance and exchange of securities tokens can be effected by anyone utilizing existing platforms. The adoption and proliferation of security token issuance and exchange are currently delayed by the enormously complex barrier of developing efficient securities compliance solutions. In the weeks and months ahead, many state-of-the-art platforms are scheduled to launch which will provide vastly improved functional integration and automated, high-level compliance.

We have lived many decades under strict regulation of consumer banking, where banks effectively had a monopoly on centralized consumer finance from money transfer to savings accounts to credit cards and loans. Disruptors such as Revolut and TransferWise have innovated with advanced, integrated technology and complex compliance mechanisms to breach barriers enabling the displacement of banks from consumer finance for the first time. Though barriers in the securities industries are much higher, they will likely be overcome by the innovation of technologists and financial service crowdfunders tokenizing securities. Fuelled by the enormous scale of injected capital generated by crypto currency, these innovators will leap over traditional securities industry players, with Main Street disrupting Wall Street.

This post is written by Sheldon Freedman, a fintech and funds lawyer at Hassans in Gibraltar.

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals