Brexit has cast a shadow over business for almost three years now, creating uncertainty and a reticence in the world of business. However much like any other major economic or political event, there will undoubtedly be sectors and businesses that benefit from the changes. One that might take off is that of RegTech.

The financial crash of 2008 created a huge amount of mistrust toward big banks and FinTech entrepreneurs have taken advantage of that. The disintermediation of banks from areas such as travel money has given rise to a new kind of financial service firm, an area set to carry on this trend. There are some brilliant ideas in FinTech and the problems they solve are widely unrelated to Brexit meaning that investment is likely to continue to grow.

In much the same way as FinTech came from the financial crash, existing sectors will be disrupted and new ones created to tackle problems that arise.

So, if the Financial Crash saw the birth of FinTech, can Brexit see the rise of RegTech? According to Luke Davis, CEO of IW Capital: it is most likely.

“The first sector that looks set to benefit is regulation and regulation technology. With Brexit there are going to be more problems to solve, and entrepreneurs are going to come along and innovate. Everything will get more complicated with import and export, say, and some smart man or woman will come along and solve it. You just have to reverse engineer all the problems that are going to be thrown up by Brexit and then you’ve got investment opportunities. Here’s a problem, let’s find an opportunity.

Wherever’s there’s huge problems and disasters, there’s always going to be an entrepreneur who comes along and will find a solution. From my perspective, that’s exciting because these new crunch points provides opportunity and employment. I set up IW Capital in a recession after a stock market crash, and WeSwap was set up because the market was falling to pieces. What actually happened was the birth of the fintech sector. Opportunity comes out of crisis.”

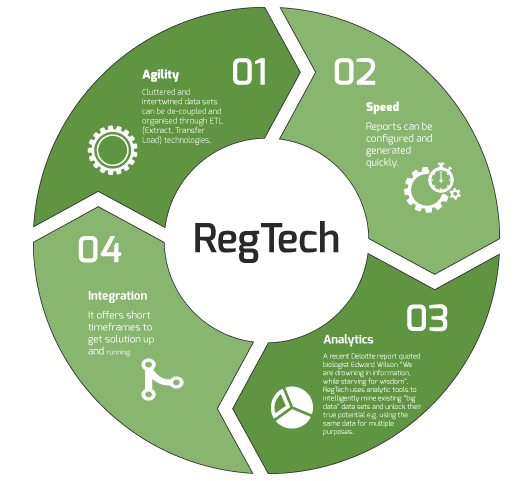

Regtech is the management of regulatory processes within the financial industry through technology. The main functions of regtech include regulatory monitoring, reporting, and compliance. Regtech or RegTech consists of a group of companies that use cloud computing technology through software-as-a-service (SaaS) to help businesses comply with regulations efficiently and less expensively. Regtech is also known as regulatory technology.

And in a scenario where regulation can become a mess to navigate, the implementation of RegTech and those companies that promote them will be at a position of advantage.

Peyman Khosravani is a global blockchain and digital transformation expert with a passion for marketing, futuristic ideas, analytics insights, startup businesses, and effective communications. He has extensive experience in blockchain and DeFi projects and is committed to using technology to bring justice and fairness to society and promote freedom. Peyman has worked with international organizations to improve digital transformation strategies and data-gathering strategies that help identify customer touchpoints and sources of data that tell the story of what is happening. With his expertise in blockchain, digital transformation, marketing, analytics insights, startup businesses, and effective communications, Peyman is dedicated to helping businesses succeed in the digital age. He believes that technology can be used as a tool for positive change in the world.