While the COVID-19 pandemic poses a significant threat to mainstream industry and commerce, it will be even more devastating to Small-to-Medium Enterprises (‘SMEs’), as a large number may not survive the economic impact of the crisis. This issue affects SME activity worldwide, however it is especially pronounced in emerging markets, where access to capital is usually more constrained than developed markets.

The World Bank states that formal SMEs contribute up to 60% of total employment and up to 40% of national income (GDP) in emerging economies, and these statistics would be significantly higher if it took into account informal SMEs.

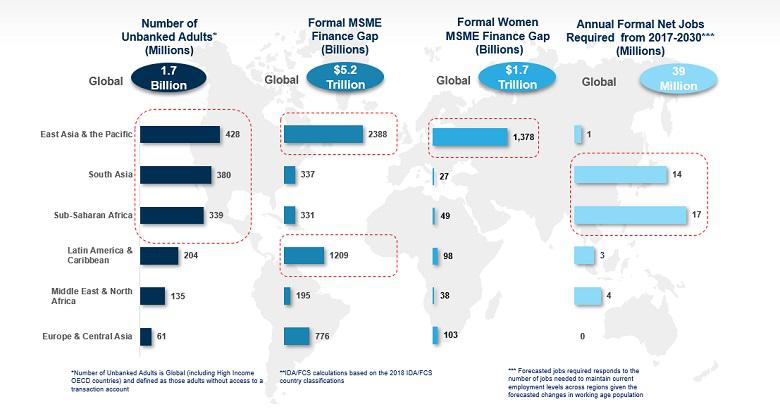

Prior to the crisis, SMEs were already less likely to be able to obtain bank loans than large firms, instead, relying on internal funds, or cash from friends and family, to launch and initially run their business activities. The International Finance Corporation (IFC) estimates that 65 million firms, or 40% of formal micro, small and medium enterprises (MSMEs) in developing countries, have an unmet financing need of $5.2 trillion every year, which is equivalent to 1.4 times the current level of the global MSME lending.

It is important that measures are put in place to save as many SMEs as possible from collapse, thereby protecting jobs and livelihoods. In addition, SMEs in the medical services sector require support in order to respond to the immediate health challenges that the pandemic presents. On the other hand, SMEs in the food and agriculture value chain need assistance to enable them to contribute to the humanitarian response in the aftermath of the pandemic to strengthen food security.

How do Stock Exchanges in emerging markets effectively respond to and mitigate the impact of COVID-19 in their respective markets, and does the current model have to change?

The SME challenge

Many SMEs have difficulty in funding advisors to prepare them for listing on an exchange. The process can be cumbersome and expensive, and as such daunting, even where the exchange growth segment listing rules are more flexible. It is contradictory because SMEs have huge needs for capital and the economy generally cannot operate without them. In many markets the solution has been to classify SMEs as ‘companies large enough to fund their entry onto an exchange’. This, while enabling the biggest SME’s to access exchange traded facilities, has worsened the situation for those that are smaller, condemning them to only those sources of capital from which money raised would come in small amounts.

Stock Exchange growth market segments were established in a bid to resolve these challenges, and create a stream of securities issuances from companies that will grow into major users of the exchange traded route to raise capital. However, in establishing such a segment, many emerging markets exchanges did not foresee challenges like COVID-19. This on initial viewing may seem like a hindrance, yet it results in a major opportunity to establish the segment. The example set by the more advanced countries, which have set aside large stimulus funds for the SME sector due to COVID-19, must be emulated in emerging markets, as the SME sector is the largest employer and as a sector may be the most productive in the economy. That said, changes to the emerging market Stock Exchange model are required to harness such an opportunity.

The main priority for most emerging markets is to increase the volume of securities trading. To achieve this requires more listings, especially SMEs, more investors, and lower overall fees for participants. In addition to this, ‘millennials’ are now expecting an instant access to real-time market data and the possibility to trade anytime and anywhere.

There needs to be a new way of investing into securities, to enable all possible advantages that will attract more investors, facilitate MSMEs to raise capital, improve the exchange experience for participants and bring value-added services to the ecosystem.

What are the issues that need to be solved?

The capital raising process is too manual and antiquated at the moment as matching investors with assets is fraught with challenges and is time consuming with the secondary market being nonexistent in most cases. This new model needs to connect to investors to galvanise capital in a most effective manner whether an asset is tokenised or traditional.

Most start-ups and SMEs are lacking capabilities to easily raise capital to finance their inceptions or their projects. Bank loans are either expensive or not even an option for most SMEs as banks often require assets to back the loans. IPO requirements represent a giant leap that most SMEs will not even consider as an option considering all the efforts and costs at stake.

Private equity is another possibility, but it must be clear which profiles amongst business angels, venture capitalists and private equity (PE) Investors are more appropriate to the local market.

On another note, SMEs are facing issues to get their invoices paid in due time by their clients. The liquidity issue is a massive cause of SME bankruptcy in many countries and the crisis will only worsen this issue.

New initiatives have however emerged in the last decade that pave the way for comprehensive funding solutions for SMEs with value-added services for every development stage, from inception to IPOs, in a fully consistent service continuum. However, most emerging markets exchanges are not really adopting these in a cohesive integrated fashion and many just end up being parallel standalone initiatives as an afterthought.

What facets and benefits should a new model have?

The objectives to foster the role of the exchange by optimising conditions for equity market growth and trading volume can be achieved by:

· Offering the most efficient ways to gain initial and subsequent investments via crowdfunding, venture/PE or traditional listing and then to allow secondary trading and market interest to continue;

· Enlarging the number of ‘segments’ managed by the exchange with SMEs, micro-enterprises and start-ups;

· Offering invoice factoring and project financing services to SMEs;

· Enabling the broadest set of mass market participants to both invest and trade;

· Offering KYC/AML services; and

· Limiting intermediaries to those which add value, with the exchange playing a more active role in such facilitation in order to efficiently match capital with companies and projects.

The tokenisation of securities is key to achieving all of these benefits, therefore embracing digital assets with traditional assets to create a hybrid (combined traditional and digital) exchange. Tokenised securities solutions can lead to a complete transformation of the exchange into a catalyst for a stronger SME ecosystem by:

· Delivering significant value-added services to SMEs at a lower cost so that they will be keener to list;

· Creating a strong SME ecosystem with less intermediaries and barriers to entry;

· Reaching out to the mass market by democratising investments through fractional ownership;

· Future proofing the exchange so that other types of tokenised assets can be added; and

· Being able to use the immutable digital data stored on blockchain to combine with Artificial Intelligence (AI) so that needs of SMEs can be anticipated more effectively.

In order to facilitate emerging markets to grasp the digital opportunities, exchanges need an appropriate end-to-end solution for digital securities to service the SME ecosystem in the most modern and comprehensive way. This needs to be different from the current exchange construct by not only being hybrid, but also combine the current exchange models with crowdfunding, venture/PE and factoring platforms into an integrated end-to-end construct. Trading, clearing and settlement for any asset, irrespective of whether it is digital or not, should be seamless with aligned business, technological and operational processes.

What should happen post crisis?

The COVID-19 response requires urgent and immediate implementation, so as to minimise the extensive related economic impact. Capacitating SMEs in healthcare, food, agriculture and other key sectors can help in the immediate response to disruption caused by the pandemic. Securities exchanges in particular, can play their role in responding to the pandemic, through the trusted accountability which they bring, in the distribution of the national and global emergency funds in addition to private finance galvanised by the crisis.

Following the aftermath of the crisis, the emerging markets Stock Exchange model needs to change or risk becoming irrelevant. There is an opportunity for long term infrastructure development as well as employment preservation and creation. The complete SME ecosystem will need to be serviced by exchanges that offer the best-in-class services to companies from inception up to main board listing, via a one-stop shop portal platform. This will secure the loyalty of the SMEs, over time, and allow the exchange to accompany them in their long journey with appropriate funding and other value-added services at every stage of their development in the most regulated and secure environment.

Hirander has expertise in extensive electronic trading and FinTech spanning 25 years, with successful syndication to investors and substantial exits. He is the Chairman & CEO of GMEX Group and its climate fintech platform-as-a-service ZERO13, which won the COP 28 UAE TechSprint for the use of blockchain to scale climate finance. He is one of the Top 10 influential business leaders of blockchain technology in the UK All Party Parliamentary Group report. He is also featured in LATTICE80’s Top 100 influencer list for the UN Sustainable Development Goals agenda for pioneering blockchain technology solutions. Hirander was also recognised as the Most Influential CEO 2024 – UK (Carbon Credits) by CEO Monthly, a digital magazine published by AI Global Media.

Previously he was the co-founder and Chief Operating Officer of Chi-X Europe Limited, instrumental in taking the company from concept to successful launch. At the time of his departure in February 2010, Chi-X Europe was the second largest equities trading venue in Europe, just behind the LSE Group, and was subsequently sold to Bats Global Markets (now part of CBOE Global Markets) for $365M.