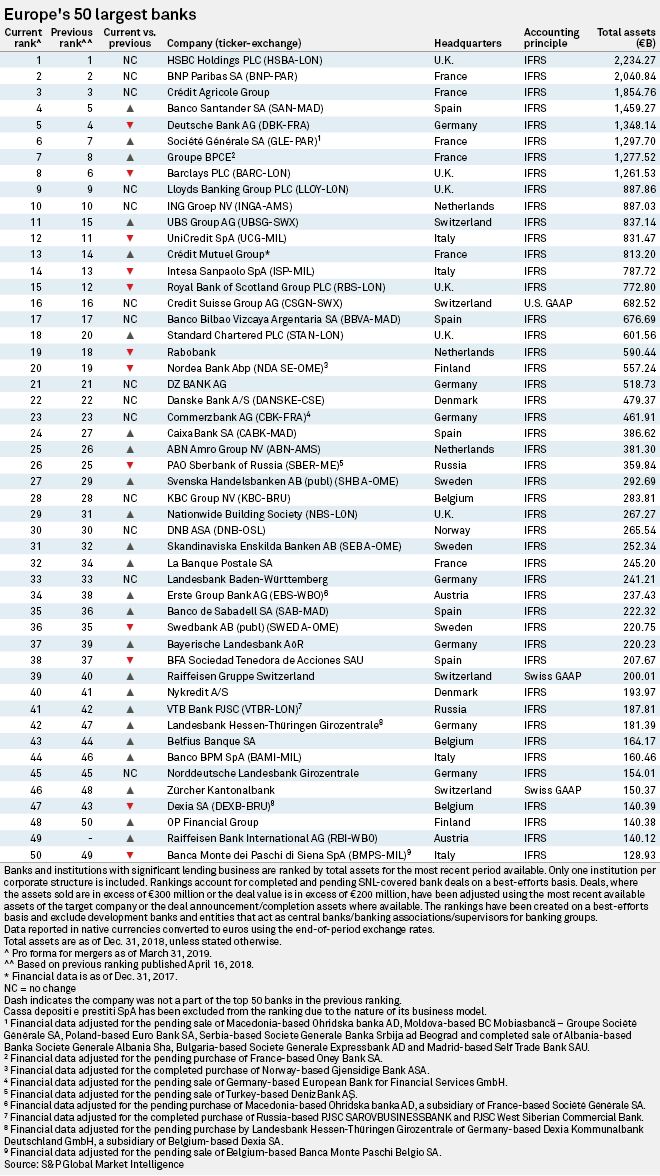

HSBC Holding PLC is for the seventh consecutive year Europe’s largest bank by assets. The UK based financial institution had assets totalling €2.234 trillion by the end of last year. With €2.041 trillion, France’s BNP Paribas SA takes hold as second biggest bank while Another French bank, Crédit Agricole Group, ranked third with €1.855 trillion. These three rank highest in the top Europe’s largest banks by assets according to S&P Global Market Intelligence.

European banks’ total assets remain steady compared to those of 2017, and in some cases, they have even lost value. HSBC is still the largest bank in Europe by assets, though two years ago, HSBC had assets of €2.251 trillion, €17 trillion more than this year. The same trend was followed by the second largest bank in Europe, BNP Paribas, which only two years ago was reported to have €2.077 trillion assets compared to this year’s €2.041 trillion.

Two of the biggest banks of Germany and the United Kingdom, Deutsche Bank and Barclays respectively, have gone through a similar experience. They performed better in S&P Global Market Intelligence’s 2017 report than last year’s one. German flagship bank Deutsche Bank went from €1.589 trillion and ranking 4th in the list to €1.348 trillion in assets and ranking 5th this year. Spain’s Banco Santander SA took over that No. 4 spot, however, a possible tie-up between Deutsche and domestic rival Commerzbank AG could result in a €1.811 trillion bank that would comfortably be Europe’s fourth-largest.

Likewise, UK’s Barclays has gone from €1.418 trillion in assets value to €1.261 trillion. That updated asset value has been reflected in its position in the rank this year, coming from 6th place to the current 8th.

The top ten is closed by France’s Société Générale SA, with €1.297 trillion in 6th place; France’s Groupe BPCE, featuring €1.277 trillion and 7 in the list; the aforementioned British Barclays in 8th place; the also British Lloyds Banking Group PLC, with €887.86 billion securing the No. 9 spot and, finally, Netherlands based ING Groep NV with €887.03 billion.

German bank Landesbank Hessen-Thüringen Girozentrale moved up the most places, to 42nd from 47th, driven by its acquisition of Dexia SA’s subsidiary in Germany.

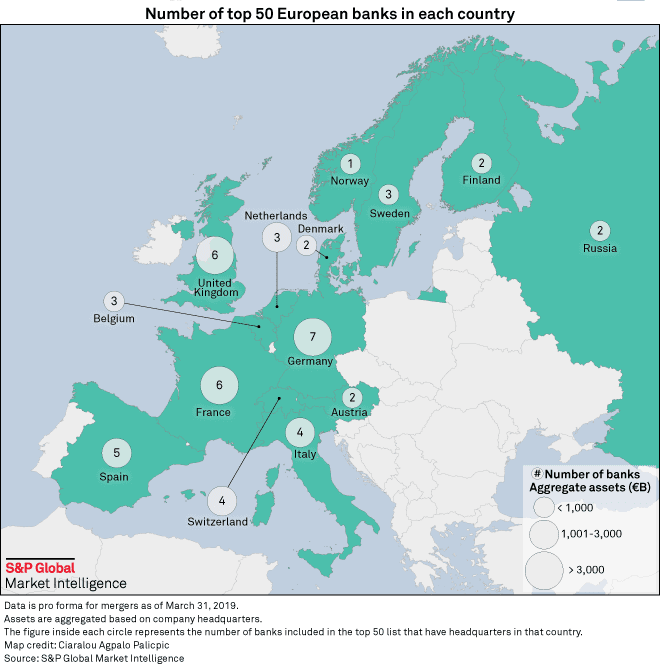

Seven of the top 50 European banks are headquartered in Germany, and these collectively have €3.126 trillion in assets. France and the U.K. each have six banks in the ranking, which together hold €7.529 trillion and €6.025 trillion in assets, respectively.

Some of the reasons S&P behind this fluctuation in assets is the uncertainty over the future U.K.-EU relationship after Brexit and growing worries about an economic slowdown in Europe, which weighed on European currencies. The euro and the British pound fell about 4.6% and 5.7% against the U.S. dollar, respectively, over last year.

The European Banking overhaul: The Banking Union

Europe’s banking system is going through a complete overhaul to avoid risk exposure and unforeseen economic developments. In fact, these last ten years have been quite adverse and most banks find it difficult to turn their activity into profit.

As Pentti Hakkarainen, Member of the Supervisory Board of the ECB, said recently that banks have strengthened their balance sheets, not only when looking at risk-based metrics but also in absolute terms. Their average Common Equity Tier 1 (CET1) ratio rose from 11.3% at the end of 2014 to 14.3% at the end of 2018, due to an increase in CET1 capital and a reduction in risk-weighted assets. Their average leverage ratio, which measures balance sheet strength without risk weight, improved from 4.0 % to 5.3% over the same period. Likewise, the level of non-performing loans (NPLs) on the balance sheets of banks under our supervision has fallen from €1 trillion in early 2015 to around €580 billion today.

“However, despite this improved resilience, banking sector profitability has remained stubbornly low. At just over 6% in the fourth quarter of 2018, euro area banks’ return on equity (RoE) was around the same as in the previous year and this leaves it still just below the level required for profits to outweigh the cost of equity. As a result, most European banks are trading at price-to-book ratios that are lower than those of their international peers,” Pentti Hakkarainen added.

To turn the tides, the European Union, through its Commission, is trying to strengthen the European Banking system and get it ready for the future. The most important initiative, the Banking Union, is probably the best example. This is a major European driven initiative to put into place a common banking supervisor, a faster and more effective single resolution mechanism and an inclusive common deposit guarantee scheme to safeguard up to €100,000 by a common eurozone fund. This Banking Union’s main objective is to transfer the responsibility for banking policy from the national to the EU level in several countries of the European Union. The banking union applies to countries in the euro area. Non-euro area countries can also join and some countries such as Denmark, Sweden, Bulgaria and Croatia have requested to enter into “close cooperation”.

This initiative started back in 2012 as a response to the Eurozone crisis. As the financial crisis evolved into the euro area debt crisis it became clear that deeper integration of the banking system was needed for the euro area countries, which are particularly interdependent. That’s why, on the basis of the European Commission roadmap for the creation of the banking union, the EU institutions agreed to establish a single supervisory mechanism (SSM) and a single resolution mechanism (SRM) for banks. The first two pillars of the banking union – the SSM and the SRM – are now in place and fully operational.

As a further step to a fully-fledged banking union the Commission put forward a proposal for a European deposit insurance scheme (EDIS) in November 2015. This would provide stronger and more uniform insurance cover for all retail depositors in the banking union.

However, a common system for deposit protection has not yet been established and further measures are needed to tackle the remaining risks of the banking sector (in particular, those related to non-performing loans, or the initiatives to help banks diversify their investment in sovereign bonds). In October 2017 the European Commission published a communication urging the European Parliament and the Council to progress quickly in the adoption of these measures and to complete all parts of the banking union’s architecture.

“Banks are private sector firms in a competitive environment – they must take the bold steps necessary to achieve sustainable profitability,” continued Pentti Hakkarainen. “And let me conclude on a positive note. Based on what I have said today, there is every reason to be optimistic that the banking industry in Europe will have a profitable and cost-efficient future.”

Simon Pearson is an independent financial innovation, fintech, asset management, investment trading researcher and writer in the website blog simonpearson.net.

Simon Pearson is finishing his new book Financial Innovation 360. In this upcoming book, he describes the 360 impact of financial innovation and Fintech in the financial world. The book researches how the 4IR digital transformation revolution is changing the financial industry with mobile APP new payment solutions, AI chatbots and data learning, open APIs, blockchain digital assets new possibilities and 5G technologies among others. These technologies are changing the face of finance, trading and investment industries in building a new financial digital ID driven world of value.

Simon Pearson believes that as a result of the emerging innovation we will have increasing disruption and different velocities in financial services. Financial clubs and communities will lead the new emergent financial markets. The upcoming emergence of a financial ecosystem interlinked and divided at the same time by geopolitics will create increasing digital-driven value, new emerging community fintech club banks, stock exchanges creating elite ecosystems, trading houses having to become schools of investment and trading. Simon Pearson believes particular in continuous learning, education and close digital and offline clubs driving the world financial ecosystem and economy divided in increasing digital velocities and geopolitics/populism as at the same time the world population gets older and countries, central banks face the biggest challenge with the present and future of money and finance.

Simon Pearson has studied financial markets for over 20 years and is particularly interested in how to use research, education and digital innovation tools to increase value creation and preservation of wealth and at the same time create value. He trades and invests and loves to learn and look at trends and best ways to innovate in financial markets 360.

Simon Pearson is a prolific writer of articles and research for a variety of organisations including the hedgethink.com. He has a Medium profile, is on twitter https://twitter.com/simonpearson

Simon Pearson writing generally takes two forms – opinion pieces and research papers. His first book Financial Innovation 360 will come in 2020.