As we saw in part 1 of this series on the future of wealth in the USA, Generation X was born between 1965 and 1980 and in 2015 they are aged between 35 and 50. Deloitte’s report found that Generation X will be rapidly ascending the wealth scale as they move into their prime years for earnings. In fact, it is estimated that:

“Increasing incomes and savings will help them amass a net worth of $37 trillion in 2030. And they will be poised to overtake Baby Boomers as America’s wealthiest generation soon thereafter.”

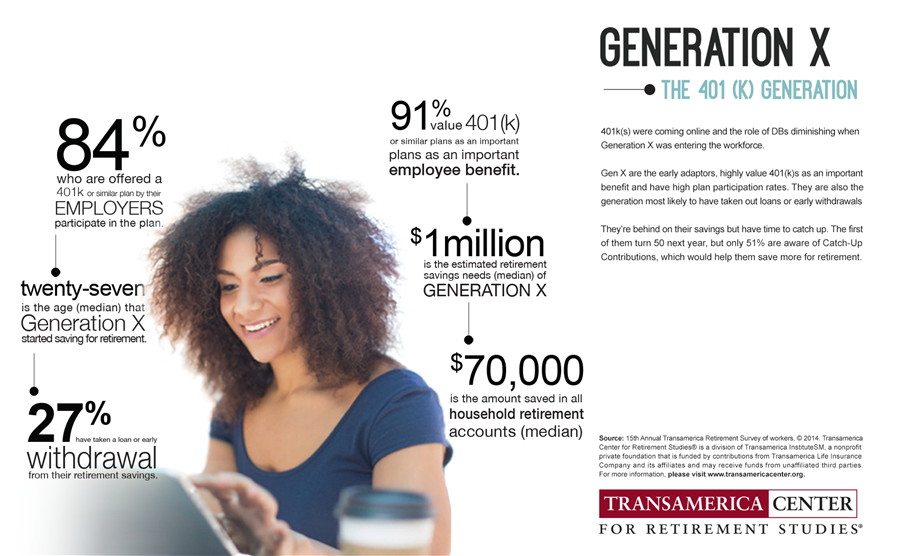

Source: Three Generations – Generation X Retirement Infographic

Indeed, for Generation X, their financial assets are estimated to rise to $22 trillion by 2030, which represents a compound annual growth rate of more than 11%, which is said to be occurring as Generation X amasses funds ready for retirement. On the other hand, Generation X are going to find that their debt levels increase over the upcoming years. It is estimated that this will grow at a compound annual growth rate of 4.3% for Generation X. An important part of this debt is student debt, which is estimated to be stretching to the budget and also to have an adverse impact on retirement savings.

Gen X – big Client for Financial Services Industry

Deloitte’s investigation found that Generation X is going to be the next big pool for financial services firms to go after. Unfortunately, Generation X faced some serious difficulties when the financial downturn occurred. This was in large part due to the fact that they had a lot of money in home equity, but the student debt problem is also continuing to have a negative influence on this generation. This means it will take longer overall for Generation X to achieve the level of wealth that the Boomers secured. Another reason for this slow growth is the fact that the generation is so small compared to the Baby Boomer generation. Generation X will not outnumber Baby Boomers until 2028.

However, the situation certainly is not all bad since Generation X still have plenty of opportunities to gain wealth. They are just approaching the years where financially they will be the most productive. They will be likely to start to see income rise and debt fall. This makes this group an excellent target for financial services companies. According to Deloitte, many financial services companies have been slow on the uptake in this regard. They may be so late that they are too late to get Generation Xers on board. Thirty-seven per cent of Generation Xers were found to have more than $100,000 in investable assets as of 2015, and they are particularly high investors in property.

Financial Concerns

The Deloitte study also noted that Generation X does face some issues in creating a financial future that is secure. Many seem to be comfortable with higher debt as they age, and this is problematic as it limits the amount of wealth that they can acquire, even though their incomes are higher than those that went before them. In addition to this it is argued that many Generation X individuals on retirement will be likely to get lower pay outs from entitlement programmes. This does however, leave an opportunity for wealth management firms that can help Generation Xers organise their money better to plan for a secure retirement.

These findings are similar to those put forward by other industry pundits. For example, Bloomberg’s Noah Smith reported that Generation X earns more but has less, similarly to Deloitte. Smith reported on research by Pew which noted that:

“The typical Gen-X household makes about $12,000 more than its parents’ household did at the same age, after adjusting for inflation and changes in household size.”

Like Deloitte, Bloomberg reported that Generation X have less money than their parents even though they bring in more money. Overall what this means is that less than half of Generation Xers across all income groupings are richer than their parents were at the same age. This is partly attributed to the fact that Generation X was more likely to go to university and started work later, but it is also associated with declining saving rates and lower returns achievable today. It seems that Generation X still has some work to do to prepare for retirement.

Related Posts:

Top Trends in US Wealth: part 1 – Baby Boomers

Paula Newton is a business writer, editor and management consultant with extensive experience writing and consulting for both start-ups and long established companies. She has ten years management and leadership experience gained at BSkyB in London and Viva Travel Guides in Quito, Ecuador, giving her a depth of insight into innovation in international business. With an MBA from the University of Hull and many years of experience running her own business consultancy, Paula’s background allows her to connect with a diverse range of clients, including cutting edge technology and web-based start-ups but also multinationals in need of assistance. Paula has played a defining role in shaping organizational strategy for a wide range of different organizations, including for-profit, NGOs and charities. Paula has also served on the Board of Directors for the South American Explorers Club in Quito, Ecuador.