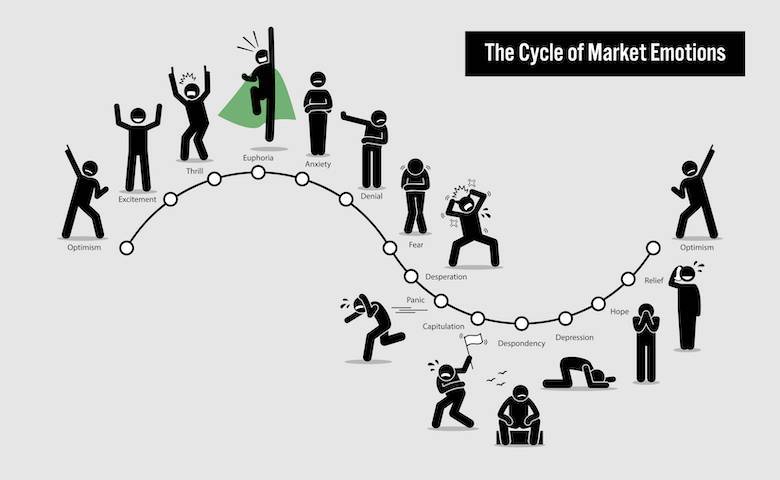

One of the key factors which influence trades in the financial market is emotions. However, basing trading decisions on emotions is tough since such a basis is hardly rational. Even if traders can read the emotions of people buying into trades, it is often difficult to read and comprehend feelings within crowds. However, combining sentiments of the market with analytical tools often aids in accurately predicting market behaviour to help you plan your trades better.

Impact of Emotions on the Market

Traders do know the sentiment of the market but it is crucial to know how to use it for making trading decisions. The impact of sentiments is often seen when certain stocks get overvalued as compared to the fundamental parameters of a company. In the same spirit, some are undervalued.

State of mind amongst a crowd of traders represents market sentiment at any point of time when the business scene is active. It is used as a pillar in deciding effective strategies by experienced market analysts. They incorporate such information along with fundamental analysis, news, and technical analysis of trends and movements on charts.

Types of Market Sentiments

In general, the crowd can be optimistic and bullish, or alternatively pessimistic and cautious (such as in a bear market). This could be a market of forex, cryptos or stocks. Hence, you need to identify the current trend that helps predict future or overall sentiment and provides trading opportunities accordingly. Big players in a trading scenario such as institutional banks can impact sentiment. They can manipulate the situation as well. For instance, they might wait till the crowd gets bearish or bullish and then use their trading power to reverse the trend.

How to Make Your Trading Choices

As per bearish or bullish trends, you can opt for trading strategies accordingly. For instance, you could go with the current trend and invest in certain currency pairs or trade against them. The second strategy involves hunting for reversals that identify resistance or support levels. Here you also take into consideration overall market sentiment. This helps you decide when a breakout can happen.

In the case of emotion-based trades, safe havens are important. That is mainly because in uncertain times, emotions can move either way in short periods of time. For example, in such cases people often invest in assets such as gold. This is a good stance to take when volatile assets enter a bear market. Such situations also create bullish markets for safe-haven assets.

Taking Advantage of Sentiment Analysis

This can help investors predict movements in stock markets. It acts as a directional signal to figure out whether to hold certain stocks for long or short time periods. Many hedge funds incorporate sentiment analysis in trading strategies.

Conclusion

If you are a short-term trader in forex, you usually depend on two factors for predicting returns: volume and price. Many investors also add sentiment as another factor for the short term, which provides a fresh perspective on such trades.

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals