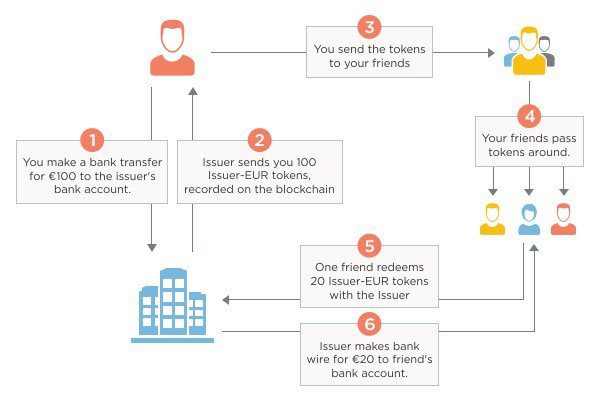

The way in which digital tokens operate is complex and can maintain multiple characteristics – from an investment contract, to something necessary for utilizing a digital platform, to a form of payment or exchange. And to truly understand digital tokens, the Chamber of Digital Commerce has introduced a series of reports focused on the rapidly evolving token landscape, its complexities, the laws and regulations that apply, and the trends, facts and figures behind them.

The second edition, “Understanding Digital Tokens,” will be released as a series of reports, providing the industry and policymakers with an even deeper dive into the overall regulatory and market landscape of the token ecosystem.

“We are in a moment when technological advancement is pushing the boundaries of decades-long established law. These laws were made at a time when tokenized assets and instantaneous digital transfers of value were not contemplated. It is exciting to be a part of it, but it also entails risks,” said Amy Davine Kim, chief policy officer, Chamber of Digital Commerce. “We view this as an important resource to provide policymakers, regulators, and practitioners with the tools to make informed decisions when engaging in the token economy.”

To facilitate the development of token businesses as well as minimize incidents of fraud and compliance challenges, the next edition of the series will tackle a number of issues impacting this ecosystem.

The “Understanding Digital Tokens” reports will be rolled out as part of an ongoing series starting with the following segments:

- Considerations and Guidelines for Securities and Non-Securities Tokens – describes securities tokens with corresponding guidelines related to the legal and regulatory frameworks that apply to them. It also details the application of the securities laws, regulations, and rules of the United States for the issuance and trading of tokenized securities. This publication also republishes considerations and guidelines for non-securities tokens as published in July 2018.

- Market Overviews and Trends in Token Project Fundraising Events – presents economic and market trends, facts, and figures from 2013 to the present to better understand the scope of the growing token evolution.

The organization has also stated that they also intend to publish the following additional sections of the series afterwards, including Considerations and Guidelines for Anti-Money Laundering (AML) Compliance and Combating the Financing of Terrorism (CFT), which provides an overview of laws in the United States aimed at the prevention of money laundering and combating the financing of terrorists, as well as the rules and regulations certain categories of businesses must follow to establish formal AML policies and practices. This section includes guidelines for token sponsors and token trading platforms to consider when crafting AML and CFT compliance programs.

Another section will be about Considerations and Guidelines for Consumer Protection, which in turn evaluates how consumer protection laws may apply to digital tokens, the potential scope of federal and state consumer protection authority, and guidelines to help token sponsors and token trading platforms avoid running afoul of consumer protection laws.

In line with consumer protection and security, the chamber is also keen to publish a series called Considerations and Guidelines for Advancing Cyber Security in the Token Economy. This will be focused on considerations about the substantial rise in the frequency and impact of cybersecurity breaches across industries and how these events have extended into the token economy. This section discusses cyber security considerations for permissionless blockchains, policy and regulatory considerations, and guidelines for advancing cyber security in a tokenized economy.

Finally, Global Legal Landscapes Governing Digital Tokens will be released as their latest resource. Global legal landscapes governing digital tokens is an analysis of legal landscapes governing two additional countries, Japan and United Arab Emirates, along with an update from the United Kingdom related to tax. We will be supplementing our existing legal landscape overviews for digital tokens on a rolling basis with the introduction of additional countries.

Hernaldo Turrillo is a writer and author specialised in innovation, AI, DLT, SMEs, trading, investing and new trends in technology and business. He has been working for ztudium group since 2017. He is the editor of openbusinesscouncil.org, tradersdna.com, hedgethink.com, and writes regularly for intelligenthq.com, socialmediacouncil.eu. Hernaldo was born in Spain and finally settled in London, United Kingdom, after a few years of personal growth. Hernaldo finished his Journalism bachelor degree in the University of Seville, Spain, and began working as reporter in the newspaper, Europa Sur, writing about Politics and Society. He also worked as community manager and marketing advisor in Los Barrios, Spain. Innovation, technology, politics and economy are his main interests, with special focus on new trends and ethical projects. He enjoys finding himself getting lost in words, explaining what he understands from the world and helping others. Besides a journalist he is also a thinker and proactive in digital transformation strategies. Knowledge and ideas have no limits.