In the global M&A deals context, the US took its largest ever share of M&A value during 1H19, with 53.2% (USD 957.3bn in total global deal value). This was as much to do with its own 14.6% increase on last year’s showing as it was the downturn in Europe and Asia –38.8% and 34.2% lower respectively. That is what Mergermarket, the provider of M&A data and intelligence, has found in its latest report.

The report took a closer look to the current M&A deals made worldwide and found that nine of the ten largest M&A deals completed targeted US-based companies, six of which were the result of domestic consolidation. Amid heightened geopolitical risks and rising protectionism, global cross border activity has accounted for just 33% of dealmaking this year, compared to a yearly average of 38.7% since 2010. Worth a combined USD 5.9bn over 43 deals in 1H19, Chinese outbound investment into the US and Europe was particularly subdued, reaching lows not seen since 2009.

Although not reaching 2Q18 record levels (USD 180.1bn), at USD 133.6bn, global private equity buyout value in 2Q19 surpassed that recorded in the previous two quarters (USD 111bn in 4Q18 and USD 111.5bn in 1Q19). Three mega-buyouts have already been struck in the US so far this year – the same number as for the whole of 2018 – including two large cross-border take-private deals in 2Q19: the USD 14.2bn acquisition fiber networks operator Zayo Group by a EQT/Digital Colony Partners consortium and the USD 10.2bn acquisition of midstream oil and gas pipeline operator Buckeye Partners by Australian IFM Investors.

Other key data points include:

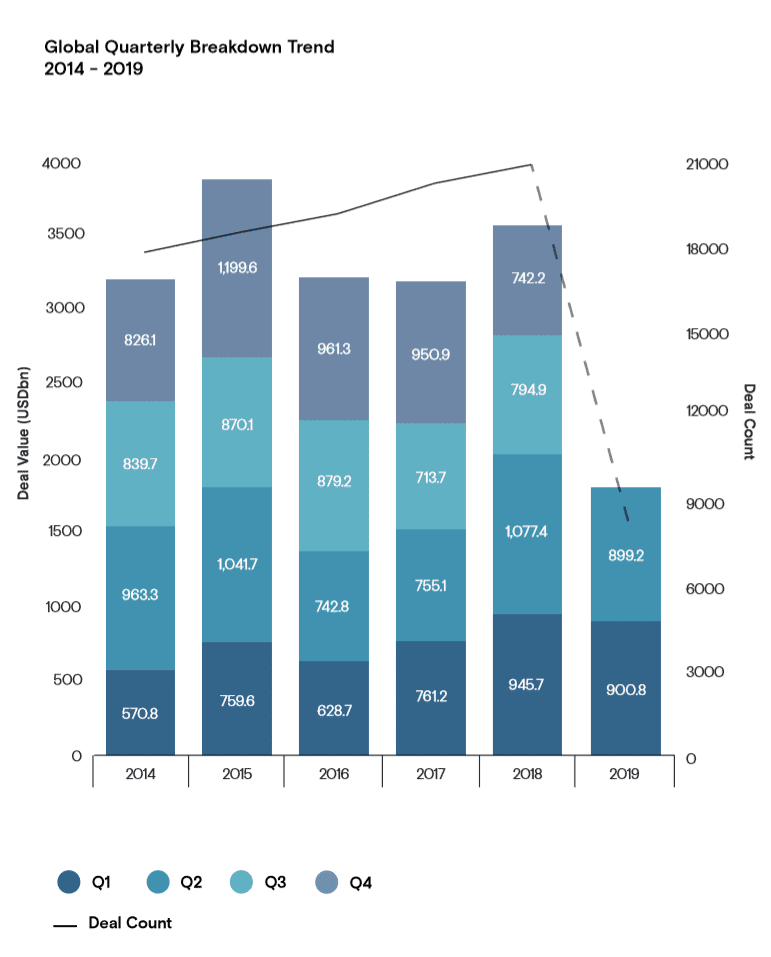

- Down 11% on 1H18 but up 17% on 2H18 by value, global M&A activity would appear to have found its post-peak cruising speed in 1H19, recording USD 1.8tn worth of deals (across 8,201 transactions).

- Global demergers reached their third-highest value on record, with 11 deals worth USD 98.3bn in 1H19.

- With 1,307 deals so far this year, the Technology sector globally was responsible for 15.9% of deal activity by volume in 1H19, its highest share on record. The sector has notably become private equity’s favourite hunting ground in recent years, accounting for 23.2% of all global buyouts so far this year, up from only 12.8% in 2013.

Beranger Guille, Global Editorial Analytics Director at Mergermarket commented: “Perhaps a sign that de-globalisation forces are starting to permeate corporate strategies, several large companies, sometimes under activist pressure, are using M&A to strengthen their grip on their home markets or focus on their core businesses.”

In the M&A world, information is the most valuable currency. Mergermarket, an Acuris company, reports on deals 6-24 months before they become public knowledge. “With the largest network of dedicated M&A journalists and analysts, Mergermarket offers the most comprehensive M&A intelligence service available today. Our reporters are based in 67 locations across the Americas, Europe, Asia-Pacific, the Middle East and Africa,” the company stated.

Hernaldo Turrillo is a writer and author specialised in innovation, AI, DLT, SMEs, trading, investing and new trends in technology and business. He has been working for ztudium group since 2017. He is the editor of openbusinesscouncil.org, tradersdna.com, hedgethink.com, and writes regularly for intelligenthq.com, socialmediacouncil.eu. Hernaldo was born in Spain and finally settled in London, United Kingdom, after a few years of personal growth. Hernaldo finished his Journalism bachelor degree in the University of Seville, Spain, and began working as reporter in the newspaper, Europa Sur, writing about Politics and Society. He also worked as community manager and marketing advisor in Los Barrios, Spain. Innovation, technology, politics and economy are his main interests, with special focus on new trends and ethical projects. He enjoys finding himself getting lost in words, explaining what he understands from the world and helping others. Besides a journalist he is also a thinker and proactive in digital transformation strategies. Knowledge and ideas have no limits.