Last week we saw the finishing of the Jackson Hole conference. As that concluded Jay Powell all but admitted that a September rate cut was happening along with a softening stance for future cuts if economic data continues to disappoint.

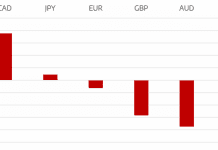

Post the Powell comments risk assets rallied with a strong response from both equity and risk currency markets. The US Dollar fell losing around 2% on the week with the DXY breaking critical support and falling to around 100.6. The Dollar fall was more on the confirmation as much of what was released was already priced into the market.

As expected, risk currencies performed well with the NDZ the standout as it rebounded from recent losses. JPY followed in also supported by a more hawkish tone from the BoJ.

GBP ended the week in positive gains but with a level of uncertainty around the BoE and future rate cuts. Market expectations are that a September cut is becoming less likely and are now looking more towards November as the next point of rate reduction.

Oil and gas become the broken record of no direction. Once again intra week vol remains high but direction remains poor, and Oil remains still in its long-term channel.

The week ahead we look at the risk rally and we fully expect that to continue. US CPI and GDP will bring the next big data test, and a strong number could give the markets something to think about in the short term.

Weekly Majors’ Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs. The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post US Rate Cuts on The Horizon first appeared on trademakers.

The post US Rate Cuts on The Horizon first appeared on JP Fund Services.

The post US Rate Cuts on The Horizon appeared first on JP Fund Services.