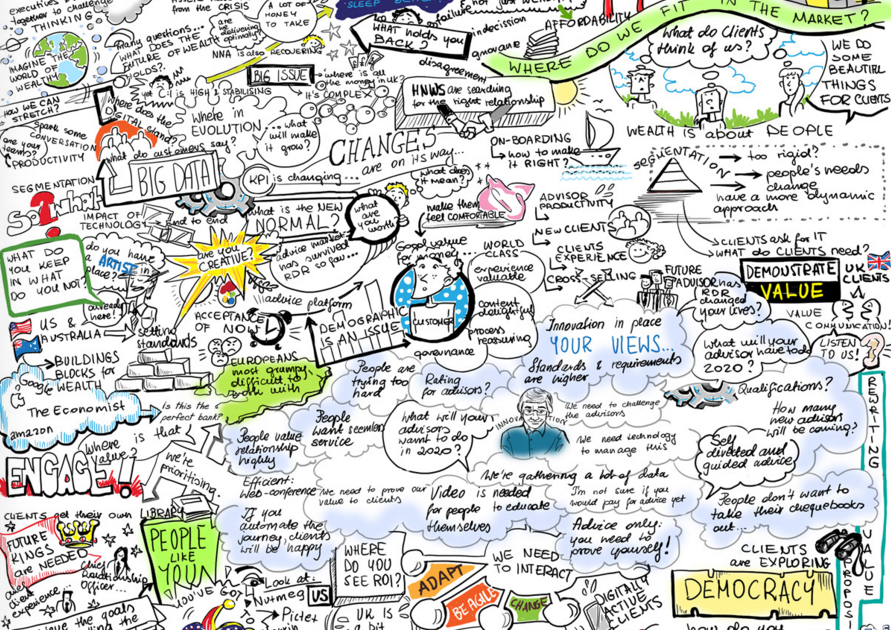

So why does global wealth intelligence matter and how it relates to your clients?

With the advent of big data and analytics wealth intelligence services are critical to look at wealth creation and analyse different trends in wealth creation and wealth individuals.

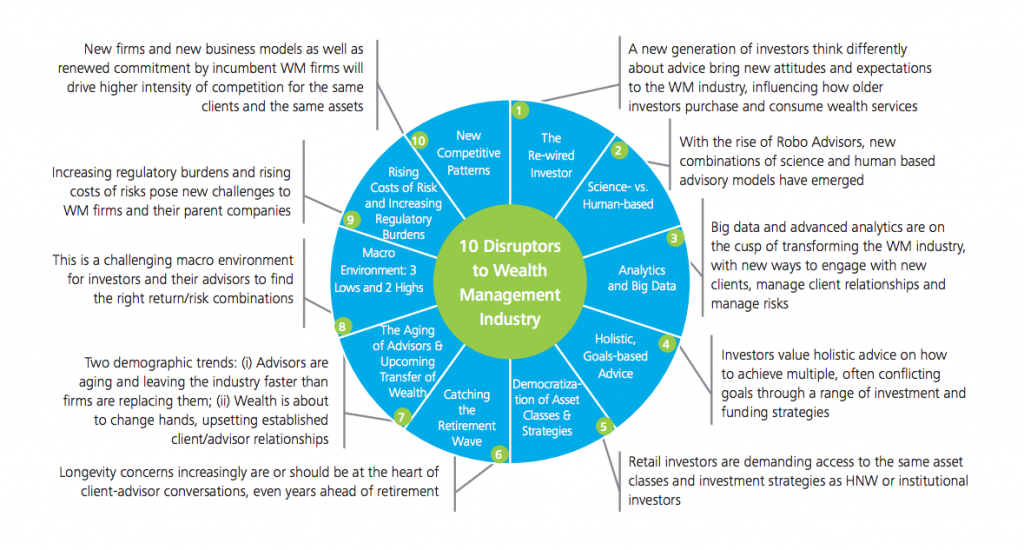

New wealth management (WM) firms and new business models as well as renewed commitment by incumbent WM firms will drive higher intensity of competition for the same clients and the same assets. Moreover the global increasing regulatory burdens and rising costs of risks pose new challenges to WM firms and their parent companies new challenges in how to operate.

Big data and advanced analytics are disrupting and transforming the WM industry, with new ways to engage with new clients, manage client relationships and special manage risks and growing stats and trends. Two demographic trends are critical to look at the industry:

1. Advisors are aging and leaving the industry faster than firms are replacing them; (

2. Wealth is about to change hands, upsetting established client/advisor relationships Investors value holistic advice on how to achieve multiple, often conflicting goals through a range of investment and funding strategies

The market trends are changing and more and more companies are looking for ways to target those with the highest net worth also known as the billionaires. Of course, the targeted market wants to be treated and communicated with the same luxury they are used to. Since those with ultra high net worth prefer purchasing luxurious items such as branded apparel, designer goods, leather products, jewelry, etc – the comforts of digital shopping does not fit their lifestyle.

This is where bespoke marketing techniques come in. Bespoke marketing techniques are tailored according to the client’s requirements. It engages the targeted consumers in an effective and holistic way. According to surveys, the traditional modes of digital marketing don’t work for the ultra-wealthy. While social media campaigns are still the best way to target individual prospects, those with ultra high net-worth are more prone to buying luxury items through traditional approaches such as referrals, events, and partnerships.

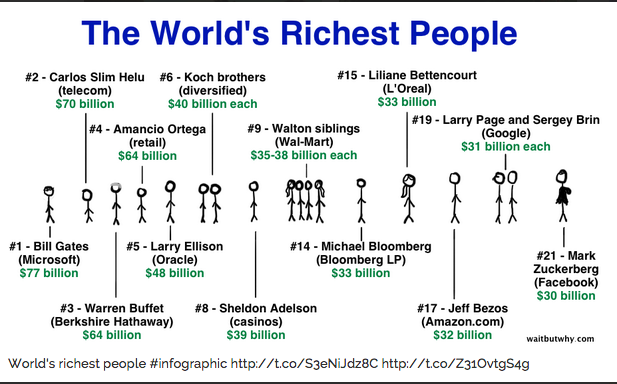

Wealth Intelligence! How Many Billionaires there are in the world?

According to statistics, the number of billionaires in the world has doubled since 2009. A report in Oxfam showed that around 62 billionaires in the world own as much wealth as poorer half of the world’s population.

Bill Gates remains the richest in the world for the past three years holding a net worth of $75 billion. Amancio Artego of Zara has a net worth of $67 billion followed by Warren Buffet who owns approximately $60.8 in net worth. Mark Zuckerberg, the founder CEO of the social networking platform Facebook is worth $47.7 billion and one of the youngest on the Forbes list. Data also shows that the United States of America has a total of 536 billionaires – the highest in the world. They are followed by china, Germany, and India who have 213,103, and 100 billionaires respectively.

In a recent study conducted by the global wealth intelligence, the individuals with the highest net worth make up 0.004% of the population which means that they possess approximately 13% of the wealth globally. According to statistics in a report by WealthX, most billionaires have one spouse and two children which represent 845,000 individuals worldwide.

One company to watch working in wealth intelligence and wealth management intelligence research is Wealth X. Their work is particular sharp in the way they have been analysing wealth and new ways of analysing and looking at the sector such as this video highlights:

Wealth-X And UBS Billionaire Census 2014 from Wealth-X on Vimeo.

Summary: Wealth Intelligence – Wealth Management fast growing industry in profound growth and transformation:

Wealth Management (WM) is one fast growing and in profund transformation. It is one of the most attractive sectors within financial services as fintech starts shifting the way it has been run in the last decades, or should we say centuries.

This is happening for 2 reasons as Deloitte research concludes in this insightful study: 10 Disruptive trends in wealth management :

1. WM businesses tend to have greater growth prospects, lower capital requirements, and a higher return on equity (ROE) than most other retail banking businesses, hence their appeal to diversified financial services firms at a time when capital is viewed as more expensive, growth is hard to come by, and equity returns for the banking industry are close to the cost of capital.

2. WM offerings are essential to attracting and retaining profitable retail customers. For instance, based on our experience, mass affluent customers can typically represent 80% or more of the net income generated by retail banks and they often regard their relationship with a provider of WM services as their most important financial relationship. As result, many diversified financial services firms are doubling down on their WM businesses.A young billionaire entrepreneur will not be attracted to the same products as a billionaire who is 50 years old – regardless of having the same bank balance. The future of wealth will be based in wealth intelligence software data driven software and services.

Marketers and wealth management professionals and players should work in wealth intelligence to observe the consumers and suggest products based on their interests and demographics. Wealth management / wealth intelligence software includes: Wealth Matching, Wealth Attributes and Wealth Snapshot/Detailed Reports for your charity database software databases. Wealth intelligence is on its inception but will control the entire industry. Be ready!

Dinis Guarda is an author, academic, influencer, serial entrepreneur and leader in 4IR, AI, Fintech, digital transformation and Blockchain. With over two decades of experience in international business, C level positions and digital transformation, Dinis has worked with new tech, cryptocurrencies, drive ICOs, regulation, compliance, legal international processes, and has created a bank, and been involved in the inception of some of the top 100 digital currencies.

Dinis has created various companies such as Ztudium tech platform a digital and blockchain startup that created the software Blockimpact (sold to Glance Technologies Inc) and founder and publisher of intelligenthq.com, hedgethink.com, fashionabc.org and tradersdna.com. Dinis is also the co-founder of techabc and citiesabc, a digital transformation platform to empower, guide and index cities through 4IR based technologies like blockchain, AI, IoT, etc.

He has been working with the likes of UN / UNITAR, UNESCO, European Space Agency, Davos WEF, Philips, Saxo Bank, Mastercard, Barclays and governments all over the world.

He has been a guest lecturer at Copenhagen Business School, Group INSEEC/Monaco University, where he coordinates executive Masters and MBAs.

As an author, Dinis Guarda published the book 4IR: AI, Blockchain, FinTech, IoT, Reinventing a Nation in 2019. His upcoming book, titled 4IR Magna Carta Cities ABC: A tech AI blockchain 4IR Smart Cities Data Research Charter of Liberties for our humanity is due to be published in 2020.

He is ranked as one of the most influential people in Blockchain in the world by Right Relevance as well as being listed in Cointelegraph’s Top People In Blockchain and Rise Global’s The Artificial Intelligence Power 100. He was also listed as one of the 100 B2B Thought Leaders and Influencers to Follow in 2020 by Thinkers360.