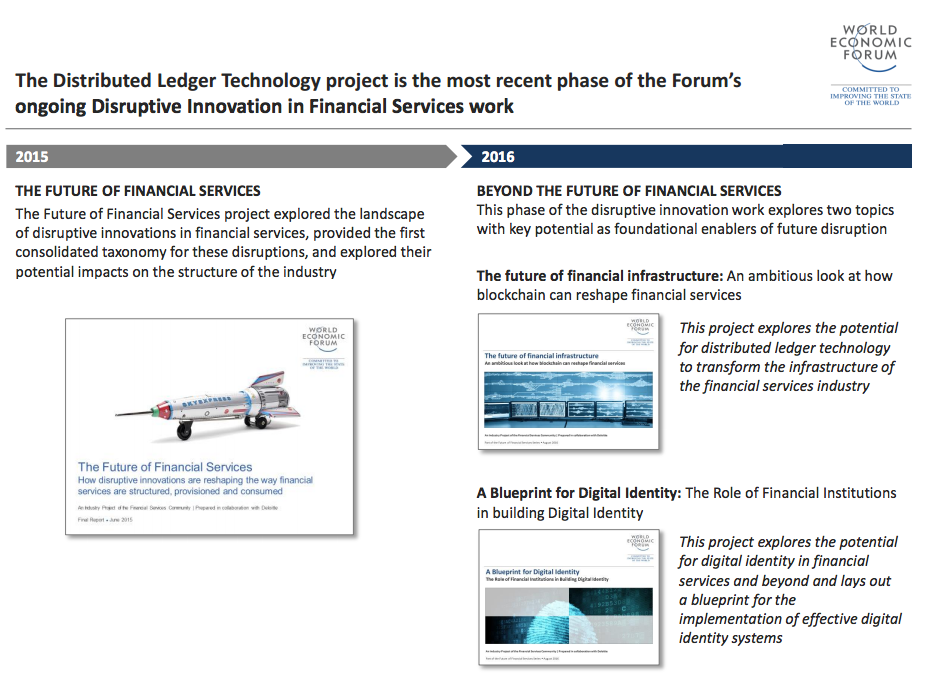

WEF Report The future of financial infrastructure An ambitious look at how blockchain can reshape financial services

World Economic Forum (WEF) Report: The Future of Financial Industry will be Powered by Blockchain.

WEF released an important Report about the future of the financial industry infrastructure that offers the most ambitious overview at how blockchain can reshape financial services:

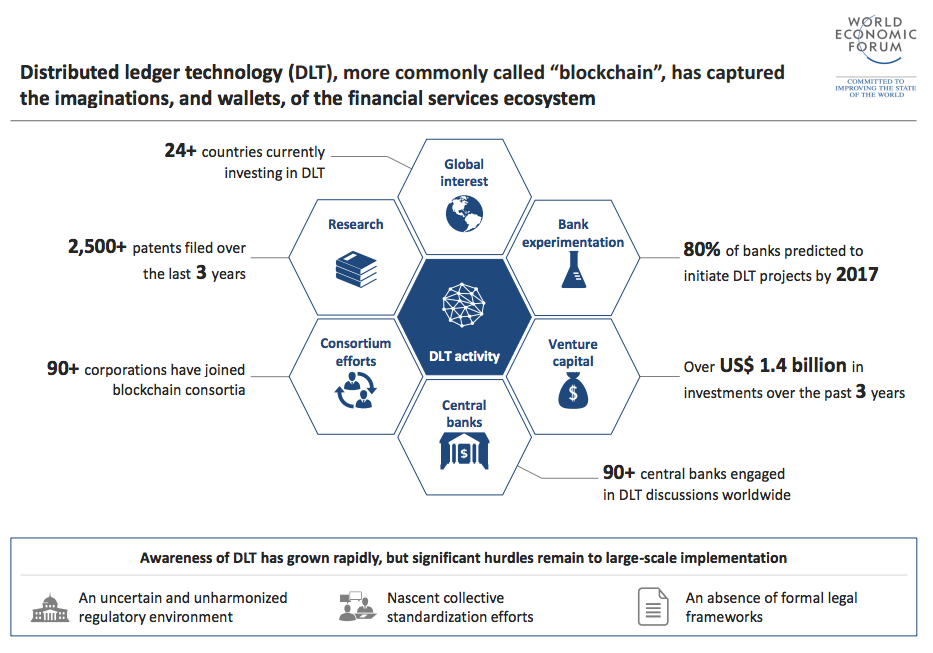

Most of the global leaders and organisations who’s who in the different industries have been researching, and now migrating, or starting to look serious for Blockchain.

In the sequence of the emergence of blockchain tech by the bitcoin community and its many issues, there are various blockchain tech-driven solutions out there that are shifting away from the Bitcoin close infrastructure and creating more robust and to better serve the various organisations, financial / banking communities.

Consistent with the World Economic Forum’s mission of applying a multistakeholder approach to address issues of global impact, creating this report involved extensive outreach and dialogue with the Financial Services Community, Innovation Community, Technology Community, academia and the public sector. The dialogue included numerous interviews and interactive sessions to discuss the insights and opportunities for collaborative action.

This influential Industry Project of the Financial Services Community – Prepared in collaboration with Deloitte Part of the Future of Financial Services Series by August 2016 highlights how the future of the financial industry is being shaped by the so called blockchain technologies.

With an analysis based on over 12 months of research, engaging industry leaders and subject matter experts through interviews and multistakeholder workshops, the report offers the following modules:

- Modules Payments: Global Payments

- Insurance: P&C Claims Processing

- Deposits and Lending: Syndicated Loans

- Deposits and Lending: Trade Finance

- Capital Raising: Contingent Convertible (“CoCo”) Bonds

- Investment Management: Automated Compliance

- Investment Management: Proxy Voting

- Market Provisioning: Asset Rehypothecation

- Market Provisioning: Equity Post-Trade

The transformation of the financial services industry is top-of-mind for everyone in the field and blockchain might be the hottest topic in the rapidly changing world of Fintech. But how can this technology really help financial firms? This report from World Economic Forum takes a pragmatic approach to answering this question.

- DLT has great potential to drive simplicity and efficiency through the establishment of new financial services infrastructure and processes.

- DLT is not a panacea; instead it should be viewed as one of many technologies that will form the foundation of nextgeneration financial services infrastructure.

- Applications of DLT will differ by use case, each leveraging the technology in different ways for a diverse range of benefits.

- Digital Identity is a critical enabler to broaden applications to new verticals; Digital Fiat (legal tender), along with other emerging capabilities, has the ability to amplify benefits.

- The most impactful DLT applications will require deep collaboration between incumbents, innovators and regulators, adding complexity and delaying implementation.

- New financial services infrastructure built on DLT will redraw processes and call into question orthodoxies that are foundational to today’s business models T.

The report builds upon the findings from Deloitte/World Economic Forum report Disruptive Innovation in Financial Services and looks at the impact of implementing distributed ledger technology across nine sectors of financial services. The reports findings suggest this technology has the potential to “live-up to the hype” and reshape financial services, but requires careful collaboration with other emerging technologies, regulators, incumbents and additional stakeholders to be successful.

ongoing Disruptive Innovation in Financial Services work

Key findings in this influential report that aims to complement existing distributed ledger technology research by providing a clear view into how financial service functions can be reimagined include:

• Distributed ledger technology (blockchain) has the potential to drive simplicity and efficiency by establishing new financial services infrastructure and processes

• Distributed ledger technology will form the foundation of next generation financial services infrastructure in conjunction with other existing and emerging technologies

• Similar to technological advances in the past, new financial services infrastructure will transform and question traditional orthodoxies in today’s business models

• The most impactful distributed ledger technology applications will require deep collaboration between incumbents, innovators, and regulators, adding complexity and delaying implementation

The report is centered on use cases, considering how distributed ledger technology could benefit each scenario. How will blockchain transform the future of financial services?

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals