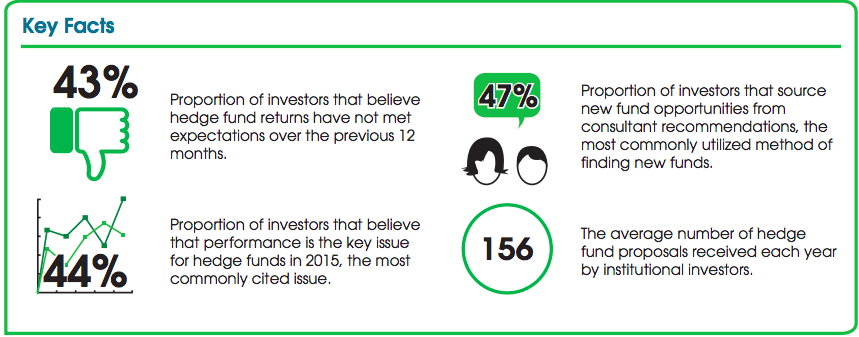

“Preqin’s mid-year surveys of hedge fund investors and managers show that performance is at the forefront of the minds of both groups. Investor dissatisfaction with the returns of hedge funds, coupled with a large proportion of investors feeling that their interests are not aligned with those of their fund managers, has left a large proportion of investors questioning the value of hedge funds as part of their wider portfolios,” according to a recent institutional investor survey conducted by Preqin- leading source of information for the alternative assets industry.

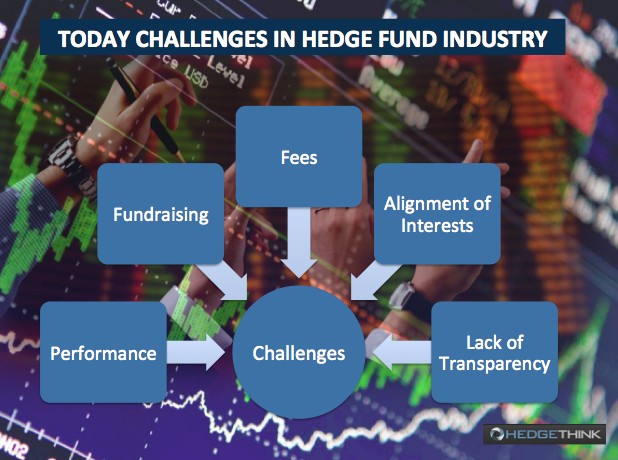

Today, the $3 trillion hedge fund industry is facing the key challenges of generating better performance, fundraising in a competitive environment and managing the regulatory environment.

Performance remains the #1 challenge for hedge funds

In recent years, hedge funds have been facing investors’ criticism for delivering below-average performance. 2014 was even the worst year performance-wise since the financial crisis. The Preqin All-Strategies Hedge Fund benchmark made gains of 4.58% only, much below 12.23% in 2013. This was much below 11.4 percent gain in S&P 500 in 2014. For the sixth year in a row, the Hedge Fund Index did worse than the S&P 500 stock index.

Both hedge fund investors and fund managers, agree that the greatest challenge the industry currently faces is performance. In the survey, one out of every two investors named performance as a key issue facing the industry and one out of every four fund managers also accepted this. Performance is more critical than any other factors.

Though the Hedge Funds have reversed the trend in the first five months of 2015. The Hedge Fund Index outperformed S&P 500 best after 2009. But this trend could not be maintained and the HRF Index sustained a decline of 1.24 percent in June due to increased global uncertainties. In July, it recorded a narrow gain of +0.01 percent only, bringing YTD performance to 2.5 percent.

Fees and Alignment of Interests are the next most important issues raised by investors

There is a growing dissatisfaction among investors over alignment of interest of fund manager and investor. One out of every two feels their interests are not aligned with those of fund managers, rather the alignment has deteriorated further in last one year.

The rationale of two and twenty fee structure has remained under persistent attack. Hedge funds normally charge a 2 percent annual management fee on assets plus 20 percent of any gain; whereas leading Index Funds such as the Vanguard 500 charges a scant 0.17 percent a year. Investors are reluctant to pay for beta, the overall market performance. The fund managers have responded to some extent. The average management fees have fallen to 1.5% and performance fees to 18.7%. But fees remain one of the key topics affecting the hedge fund industry today. It is important for fund managers to pay close attention to investor demands and restructure their terms.

Investors are concerned over lack of transparency

Investors are apprehensive over lack of availability of adequate information about hedge funds. The high level of secrecy with virtually no transparency makes hedge funds opaque. Common investors are not able to understand their complex strategies and so unable to evaluate risk and reward of investing in hedge funds. Investors believe effective implementation of the AIFMD will change the level of transparency. The directive will provide greater transparency on hedge funds and additional levels of protection for the investor.

Fundraising remains a key challenge for hedge fund managers

Fund managers are disturbed with the fundraising environment and current condition of the financial markets. The survey reveals there is stiff competition within Hedge Fund Industry to raise funds. Majority of hedge fund managers feel that competition for investor capital has increased.

An investor, on an average, picks only three out of over 150 investment proposals in a year. Most of the proposals are rejected at the screening stage especially if the fund is too small or the track record is very short. Moreover, evaluation of new shortlisted fund offers takes time. Two-third of investors take three months or more to make an investment decision.

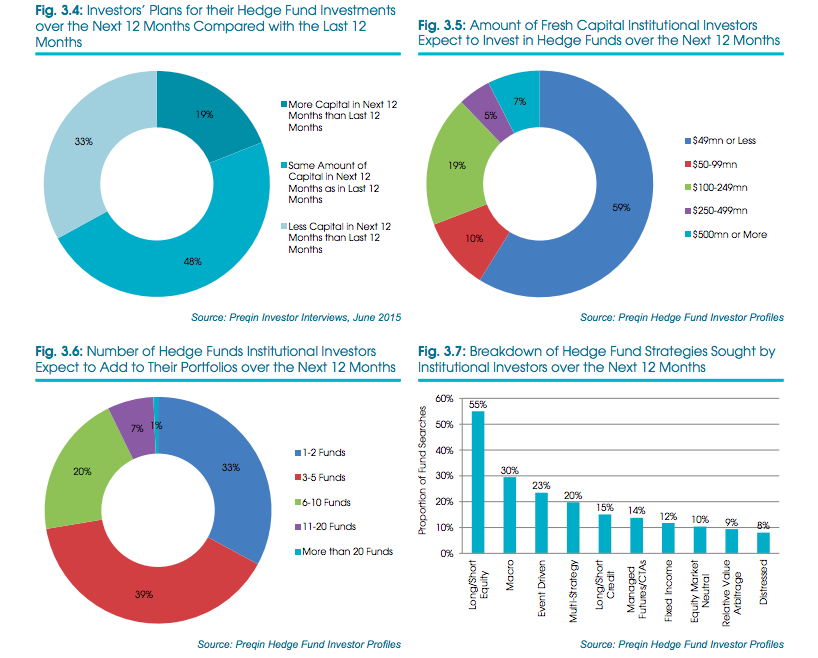

The investors are also very choosy over the fund strategy. The choice of strategies depend on many subjective factors such as investors’ outlook on prevailing market and economic situation.

Fund managers are optimistic about growth of Hedge Fund Industry

In spite of public criticism of Hedge Fund Industry in media, funds are flowing in to hedge funds. Hedge Fund Industry capital witnessed the 11th consecutive quarterly record level last quarter, reports Hedge Fund Research- a leading source of hedge fund data and indices. The hedge fund industry grew by $76bn in H1 2015 to $2.97 trillion, almost approaching the $3 trillion milestone.

81% of Fund Managers expect that the net inflows will grow further over the rest of the year. Two-third of investors are planning to invest further and even higher in hedge funds over the next 12 months. But one-third of investors are likely to invest less in this asset class.

Overall, though ongoing debate on Hedge Funds Industry will continue, the outlook for hedge funds is positive. The fund managers have no option but to address issues raised by investors and tackle the challenges to keep the hedge fund industry growing beyond $3 trillion mark.

Read More:

what is one benefit to working collaboratively on a team?

the coin republic crypto analysis

how does a block of data on a blockchain get locked?

how is having a security system for your home a risk management strategy?

why is it useful to have your bank account and routing numbers when using tax preparation software?

Peyman Khosravani is a global blockchain and digital transformation expert with a passion for marketing, futuristic ideas, analytics insights, startup businesses, and effective communications. He has extensive experience in blockchain and DeFi projects and is committed to using technology to bring justice and fairness to society and promote freedom. Peyman has worked with international organizations to improve digital transformation strategies and data-gathering strategies that help identify customer touchpoints and sources of data that tell the story of what is happening. With his expertise in blockchain, digital transformation, marketing, analytics insights, startup businesses, and effective communications, Peyman is dedicated to helping businesses succeed in the digital age. He believes that technology can be used as a tool for positive change in the world.