BarclayHedge is a globally recognized institution that has become as one of the most influential forces in the world of hedge funds. Despite its popularity and importance, not everyone knows about the ranking. Here is a closer look at the BarclayHedge Ranking, what it is and why it is published.

What is the BarclayHedge Ranking?

The BarclayHedge Ranking is a list of the top performing hedge funds over the world. On a monthly and yearly basis, they publish a list of hedge funds that have performed phenomenally over the period under consideration. While monthly data can be accessed at any time, it becomes unavailable after years end, being replaced by the yearly ranking.

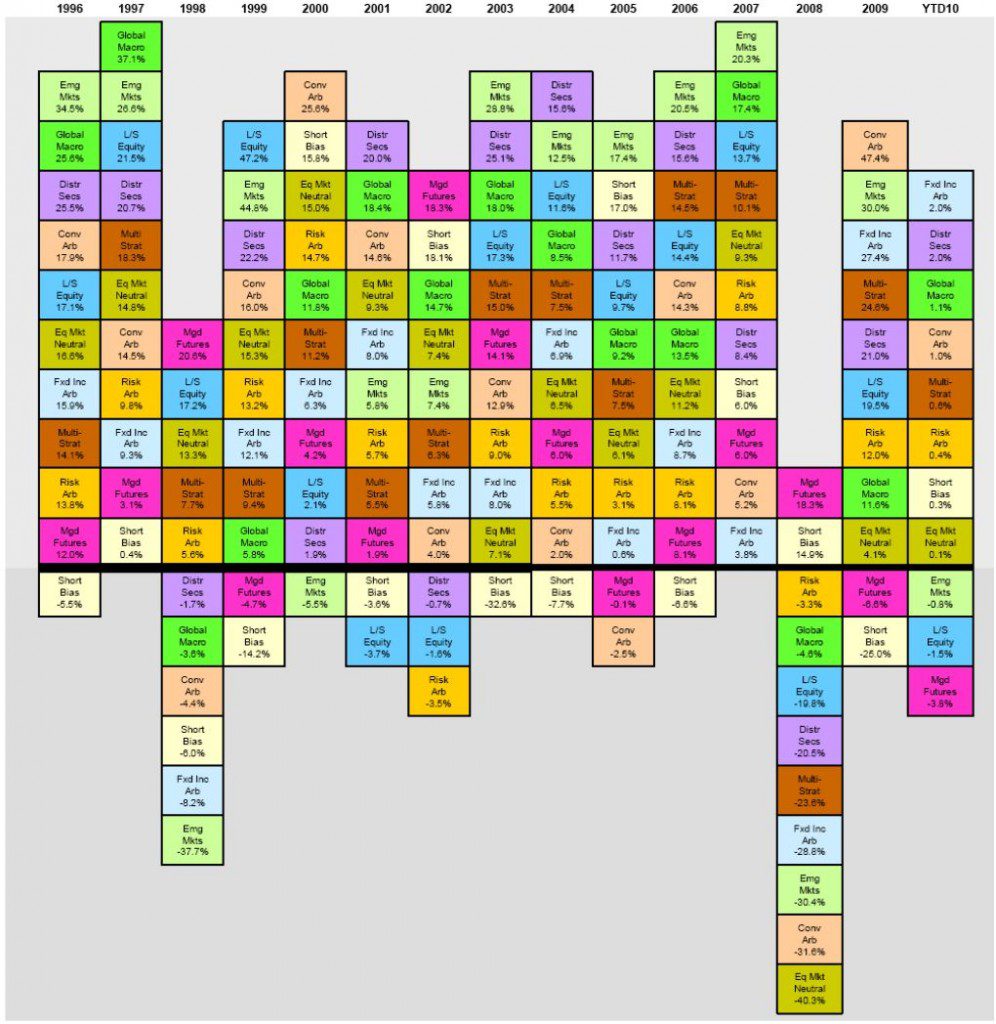

The rankings are organized into 47 different categories, based on the type, sub-type of fund and/or the region it is available in. The primary categories include:

- Convertible Arbitrage

- Distressed Securities

- Emerging Markets

- Emerging Markets Equity

- Emerging Markets Fixed Income

- Equity

- Event Driven

- Fixed Income

- Fund of Funds

- Macro

- Merger Arbitrage

- Option Strategies

- Multi-Strategy / Relative Value

- Sector Specific

Where is it Published?

The BarclayHedge Ranking is published on their website on the research ranking page here. The page is updated monthly, along with monthly rankings.

Why Is It Published?

Possibly the most important question, the BarclayHedge Ranking is published for 3 primary reasons, including recognition, information and investment opportunity.

- Recognition In the world of aggressive marketing and investing hedge funds it is vital to recognize the work of groups or firms who have ensured high performance of their hedge fund. By recognizing performance, both hedge funds become more attractive and so does the firm offering it.

- Information Acquisition More often than not, investors are looking for information about the performance of a particular fund, in contrast to other funds. For example, they may wish to identify the performance of their fund, relative to the regional market. The BarclayHedge Rankings helps them do just that.

- Investment Opportunity With information about a host of hedge funds available to them, investors can use the data of the top funds and incorporate them in their research, allowing them to make timely decisions and capitalize on apt investment opportunities.

BarclayHedge Ranking not only offers a significant amount of information to members, it allows them to see the top performing hedge funds of the month and year

Related Posts:

Introduction to BarclayHedge Database – What is BarclayHedge?

Chris Turner is a versatile content writer with a passion for technology, finance, Investing and trading. He writes extensively on the subjects of Trading, Investing, Bitcoin, Forex trading, investing and general finance. He is writing and providing advice, education and encouragement to budding investors and traders, on Hedge Fund and alternative investments and other emerging financial trends. He is a contributor writer for HedgeThink.com and TradersDNA.com.