Do you prefer to work with man or machine? That is the challenge facing the wealth management industry today as customers decide to either work with robo advisors and online services, or instead continue using traditional wealth management services that are typically offered face to face. Machines, or so-called “robo advisors” have been built off the back of the idea that the activities carried out by investment advisors can be easily offered online. This is possible with software built for the purpose.

According to Chance Barnett (2015) writing for Forbes:

“They promise lower costs, simplicity and even the bonus potential of making investing ‘fun’”.

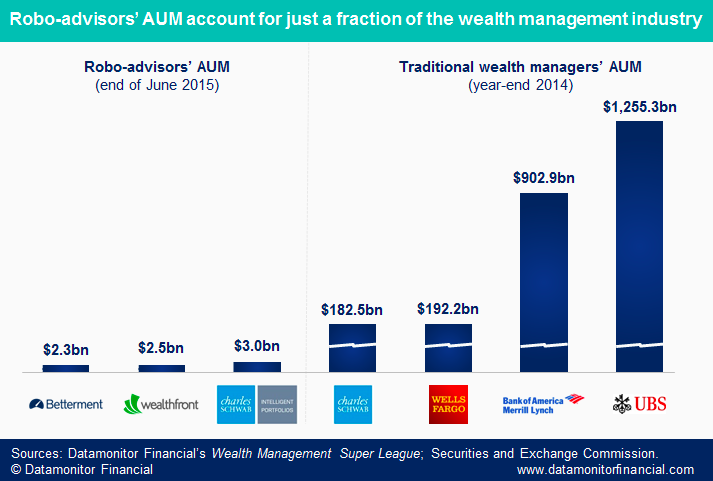

Some robo advisors have already become big names. Organisations that are well known in this field include Betterment and Wealthfront. They have been able to attract a good deal of investment. For example, it is reported that Black Rock, a major wealth management firm utilised $600 million to buy out a robo advisor platform called FutureAdvisor. Wealth management firms are starting to believe in the idea that it is worth having a foot in this market.

Why Robo Advisors became popular

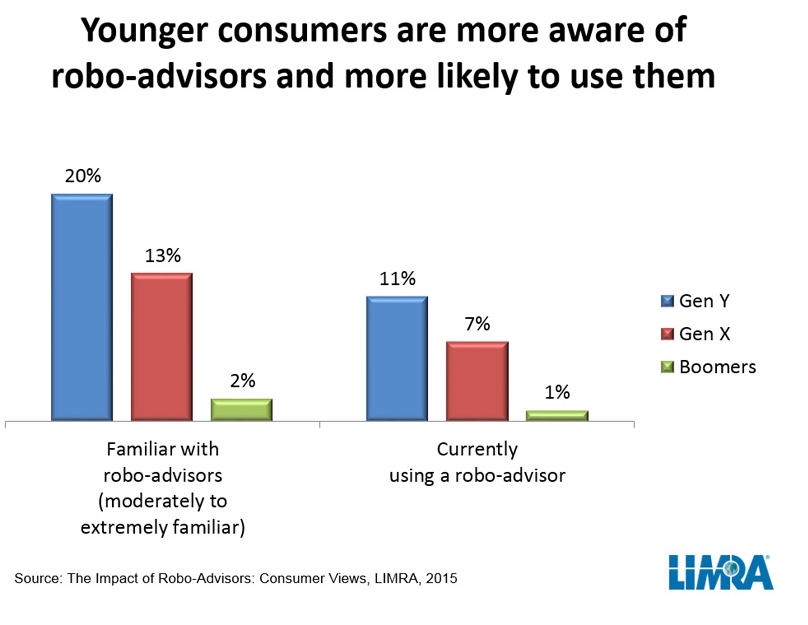

One of the reasons for entering this market has been millennials. Millennials look for services in this area and go for online services because they are very capable online, they like to go about doing things for themselves, and they reportedly do not necessarily trust the wealth management firms that are already out there. This has been partly driven, it is argued, by two very significant financial crises that have already occurred in their lifetimes. This has led some to believe that financial advisors were not to be trusted. This led some companies to pick up on this and develop services that would attract those that have a greater trust in computers than people.

Yet one of the remarkable things that has happened in this industry is that it has transpired that millennials do prefer talking to an actual person. It is reported that a study by Salesforce found that 81% of this target group like to have an advisor to either work with them to manage their money or do it for them. This is not far off the figures for those of Generation x (86%) or Baby Boomers (89%). In fact the study showed that in 47% of cases, millennials like to get investment advice face to face, while for Generation X this was 36%, and for Baby Boomers it was 46%. This means that some of the foundations of building a robo advisor, or traditional wealth management firms investing in these technologies are somewhat questionable.

Robo – Platforms

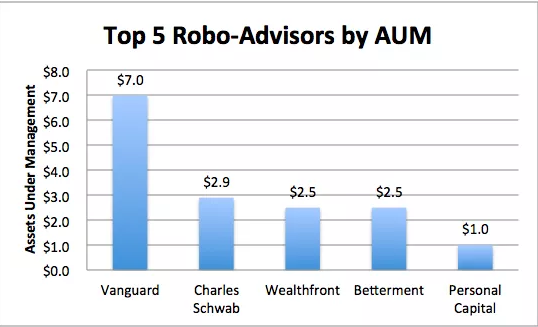

Rather than replacing advisors then, it is anticipated that they will complement them. Nonetheless, traditional players, including Schwab and Vanguard have developed robo advisor platforms. These work in line with this concept, as people can choose to communicate with an actual person if they wish. This has been beneficial as it has allowed them to cut fees and offer more through robo advisors. The hybrid system appears to be very appealing, since people can get what they need from technology and yet still have the benefit of human advice if they wish. Hybrid firms of this nature are doing better than companies like Wealthfront already.

What this means for robo advisors that do not offer human interaction is that they are really going to have to show they offer value that is not provided by other options. To date, it is explained that they have not delivered better returns, so it is hard to see how they will go about this. Additionally, they have to compete with much larger, traditional firms that have greater wealth behind them. This means that they have to invest heavily in advertising – an area where the larger companies have particularly strong competencies.

Betterment, Wealthfront, and others like them have a challenge on their hands. They may not be able to provide a human element, yet this appears to be exactly what their target market wants. This may be too costly for them. It is likely that such companies may in the future be bought out by larger, traditional firms that seek to get into the robo advisor sector of the industry but do not want to go about building their own technology to do so.

Source: How Technology Is Turning The Typical Advisor AUM Fee Schedule Upside Down

Related Posts:

How big is disruption by Robo Advisers

Wealth management trends: Main factors

How Wealth Management responds to Robo Advisers

The Emergence of Robo Advisers

Paula Newton is a business writer, editor and management consultant with extensive experience writing and consulting for both start-ups and long established companies. She has ten years management and leadership experience gained at BSkyB in London and Viva Travel Guides in Quito, Ecuador, giving her a depth of insight into innovation in international business. With an MBA from the University of Hull and many years of experience running her own business consultancy, Paula’s background allows her to connect with a diverse range of clients, including cutting edge technology and web-based start-ups but also multinationals in need of assistance. Paula has played a defining role in shaping organizational strategy for a wide range of different organizations, including for-profit, NGOs and charities. Paula has also served on the Board of Directors for the South American Explorers Club in Quito, Ecuador.